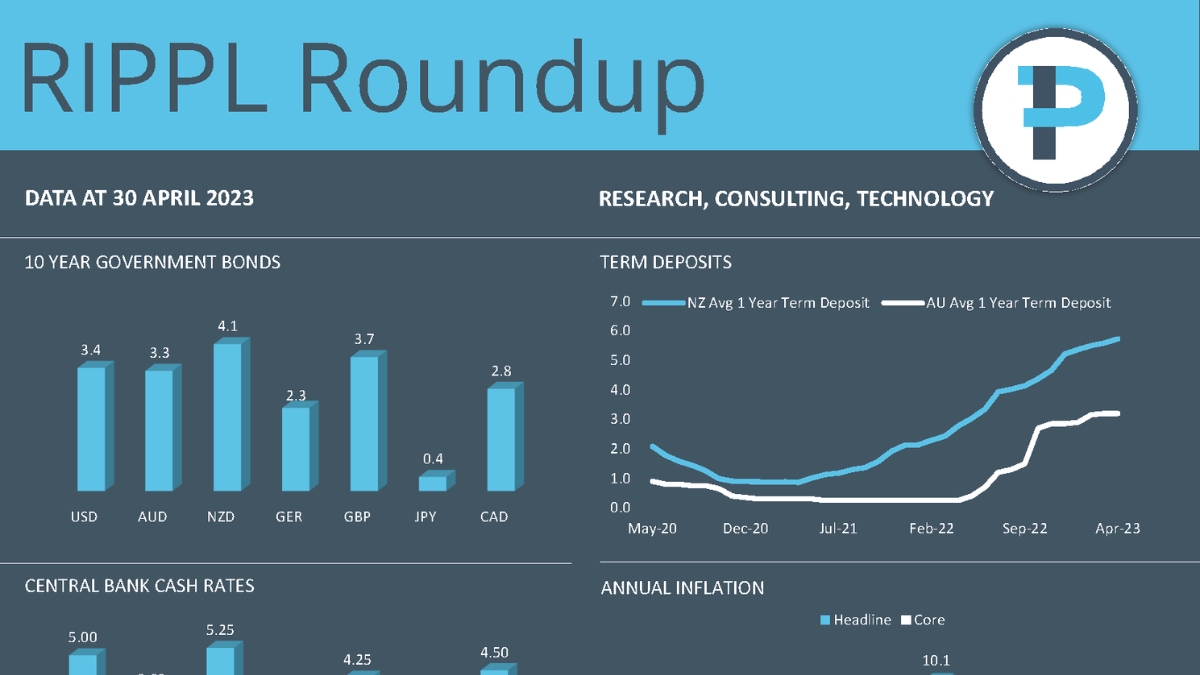

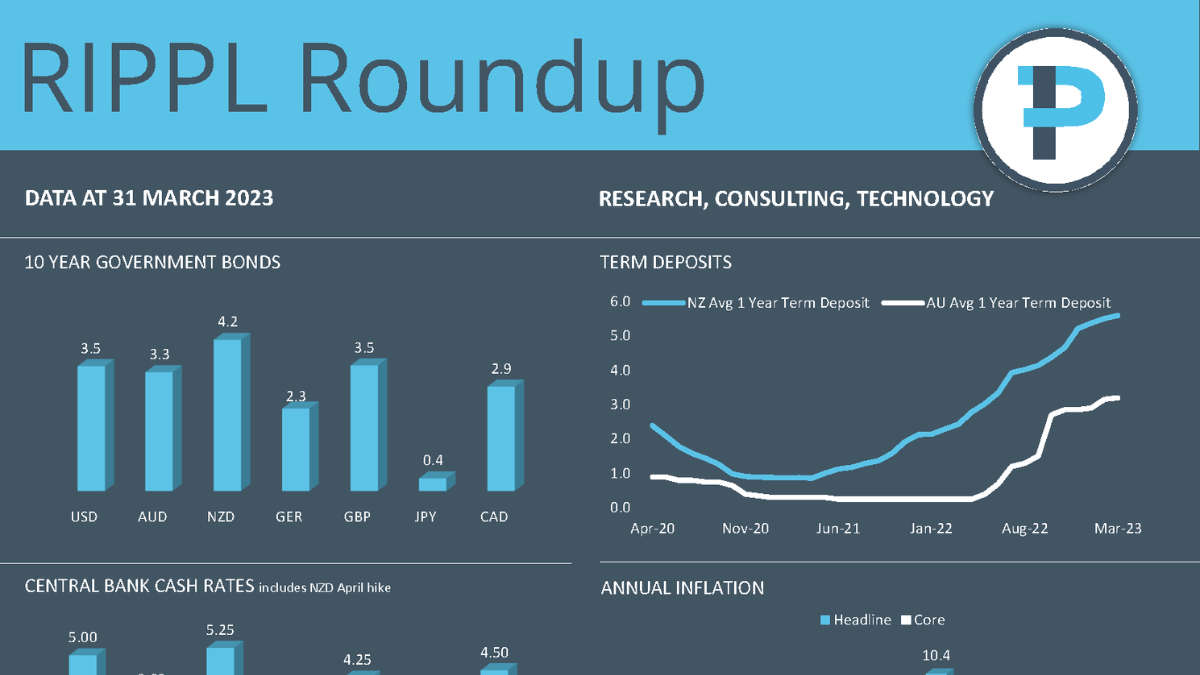

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

The roots of responsible investing arose from negatively screened investments at religious organisations. Social issues through the 60s and 70s started to influence how investment decisions were being made. Financial markets, the real economy and broader society are all interdependent. An efficient financial market should reflect the real economy and broader society over the long run, thus ESG issues should impact the ongoing concern of companies.

Responsible investment, socially responsible investing, sustainable investing, ethical investing, green investing, and ESG. What are the differences between these investment terms? How long has responsible investing even been around?

Responsible investing has become a focus area in the investment industry, but greenwashing is rife and the sales pitch is strong, so what really matters? Research IP helps many of our consulting clients navigate the maze, but no one client is the same. The monthly RIPPL Sluice provides some examples of responsible investment in action.

The views of the Research IP team on responsible investing, impact, the 17 Sustainable Development Goals (SDGs), Environmental, Social and Governance (ESG) considerations and the United Nations Principles for Responsible Investment (UN PRI).

Responsible investment, socially responsible investing, sustainable investing, ethical investing, green investing, and ESG. What are the differences between these investment terms? How long has responsible investing even been around?

Sequencing risk, or "sequence of returns risk", refers to the potential impact of the order in which returns are received on the overall performance of an investment portfolio. When markets fluctuate more widely, the timing and order of returns are of more concern, particularly for investors that have liquidity needs from their portfolios.

The RIPPL NZ Leaders highlights some market trends and how funds performed over the last 12 months. Check out the KiwiSaver and Non-KiwiSaver investment performance and accompanying RIPPL Effect reports.

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.