Within the first quarter of 2024, the US stock market displayed significant resilience, with technology and value stocks leading to substantial gains amid AI boom and despite the apprehensions about prolonged high-interest rates.

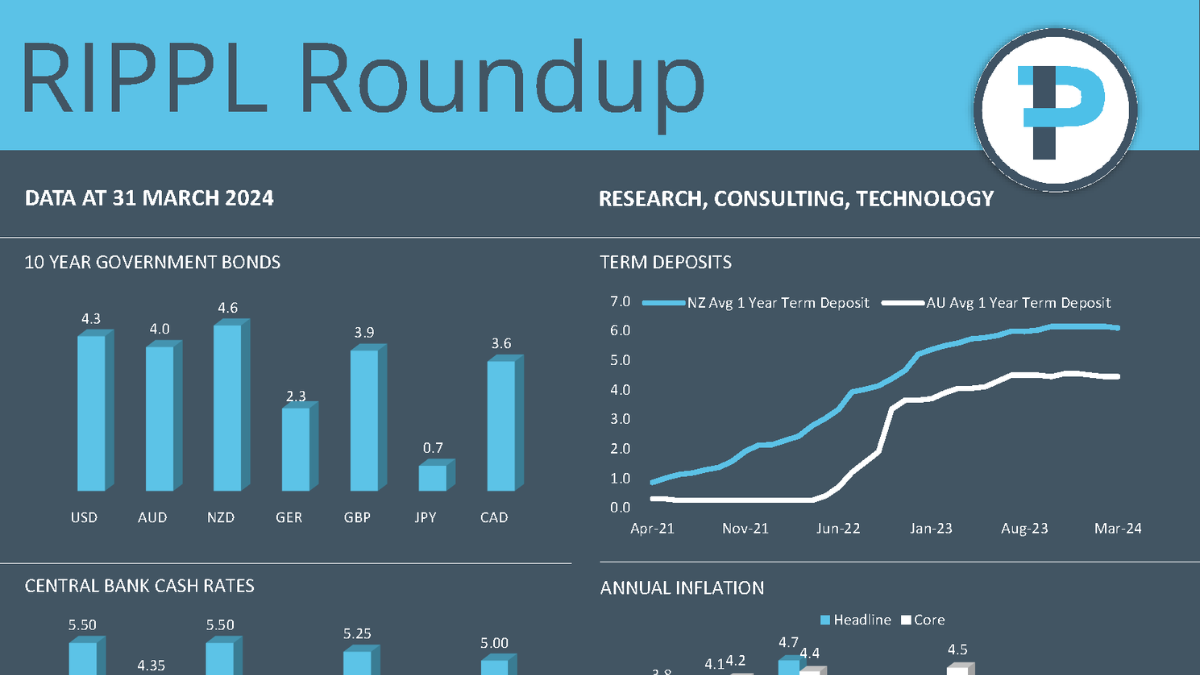

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

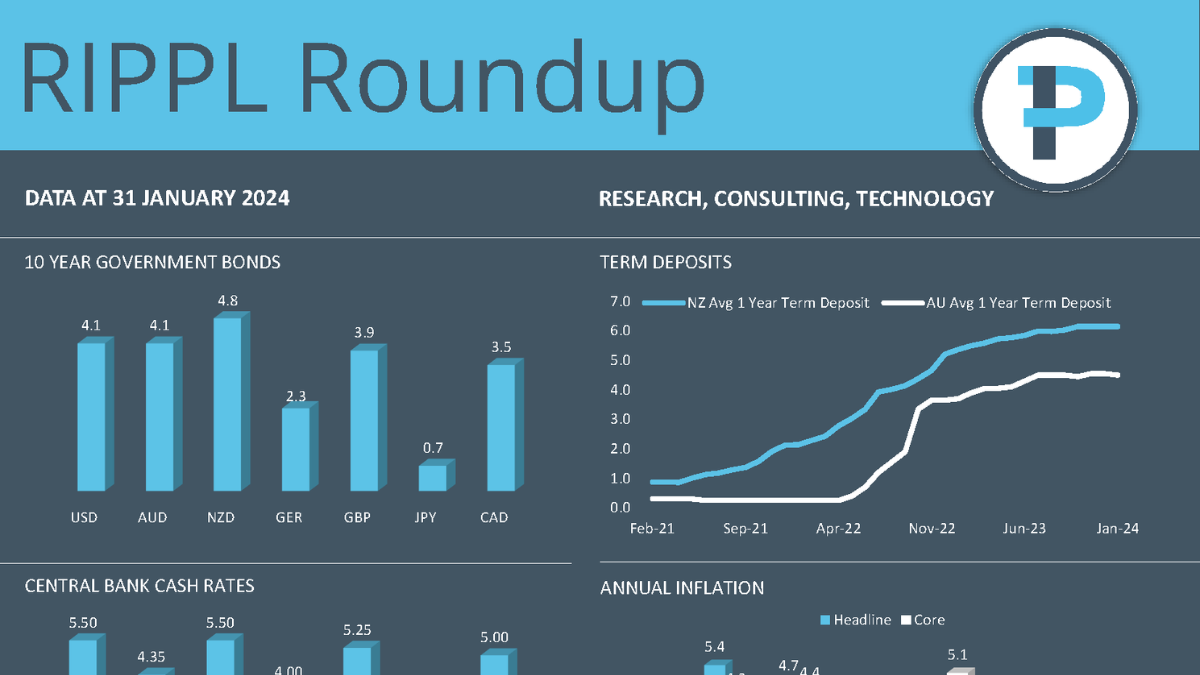

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

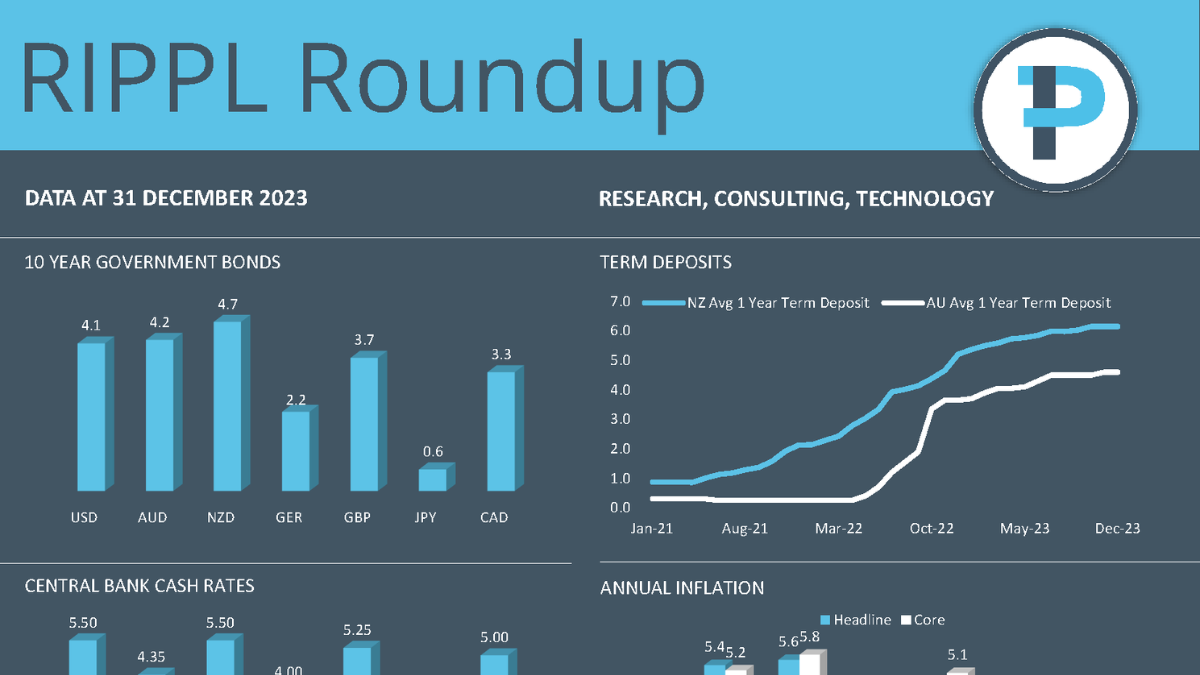

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

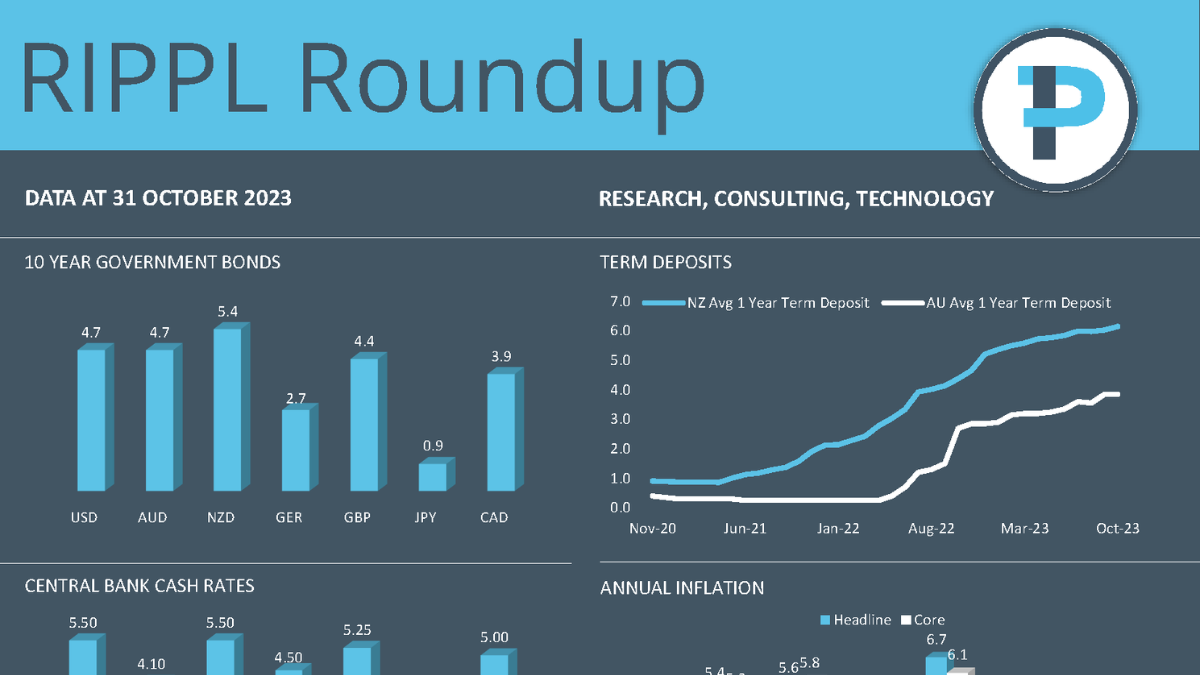

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

As 2024 approaches, the global economic and political landscape is fraught with uncertainty. Sustainable rallies in risk assets depend on reduced interest rates and easing monetary policies, potentially tied to market corrections or a decrease in inflation. Read the short version of our quarterly commentary to learn more.

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

The investment landscape has been influenced by global events and economic trends, including concerns about inflation and interest rates, unexpected post-COVID price surges, and central bank actions. Read our quarterly commentary to learn more.

Given the ongoing risks posed by inflation to households and businesses, caution is advised. Read the short version of our quarterly commentary to learn more.