The views of the Research IP team on responsible investing, impact, the 17 Sustainable Development Goals (SDGs), Environmental, Social and Governance (ESG) considerations and the United Nations Principles for Responsible Investment (UN PRI).

Sequencing risk, or "sequence of returns risk", refers to the potential impact of the order in which returns are received on the overall performance of an investment portfolio. When markets fluctuate more widely, the timing and order of returns are of more concern, particularly for investors that have liquidity needs from their portfolios.

The RIPPL NZ Leaders highlights some market trends and how funds performed over the last 12 months. Check out the KiwiSaver and Non-KiwiSaver investment performance and accompanying RIPPL Effect reports.

The RIPPL NZ Leaders highlights some market trends and how funds performed over the last 12 months. Check out the KiwiSaver and Non-KiwiSaver investment performance and accompanying RIPPL Effect reports.

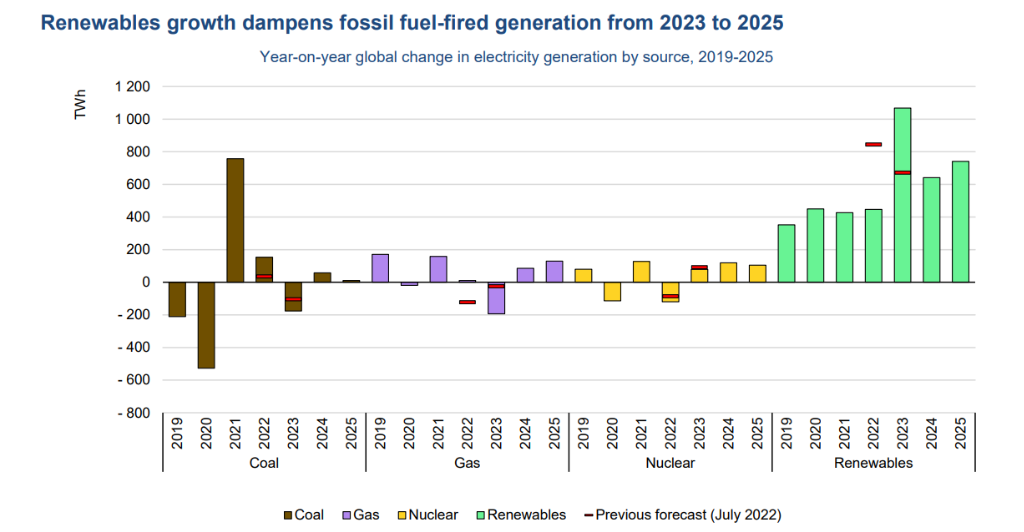

Extreme weather events in multiple regions caused power system challenges in 2022. Fuel prices surged after Russia's invasion of Ukraine, leading to a rise in coal-fired generation. Renewable power generation is set to increase more than all other sources combined, with renewables making up over one-third of the global generation mix by 2025. Nuclear output is expected to grow by 3.6% per year on average. Low-carbon generation sources are expected to meet more than 90% of additional electricity demand over the next three years.

Responsible investing has become a focus area in the investment industry, but greenwashing is rife and the sales pitch is strong, so what really matters? Research IP helps many of our consulting clients navigate the maze, but no one client is the same. The monthly RIPPL Sluice provides some examples of responsible investment in action.

The RIPPL NZ Leaders highlights some market trends and how funds performed over the last 12 months. Check out the KiwiSaver and Non-KiwiSaver investment performance and accompanying RIPPL Effect reports.