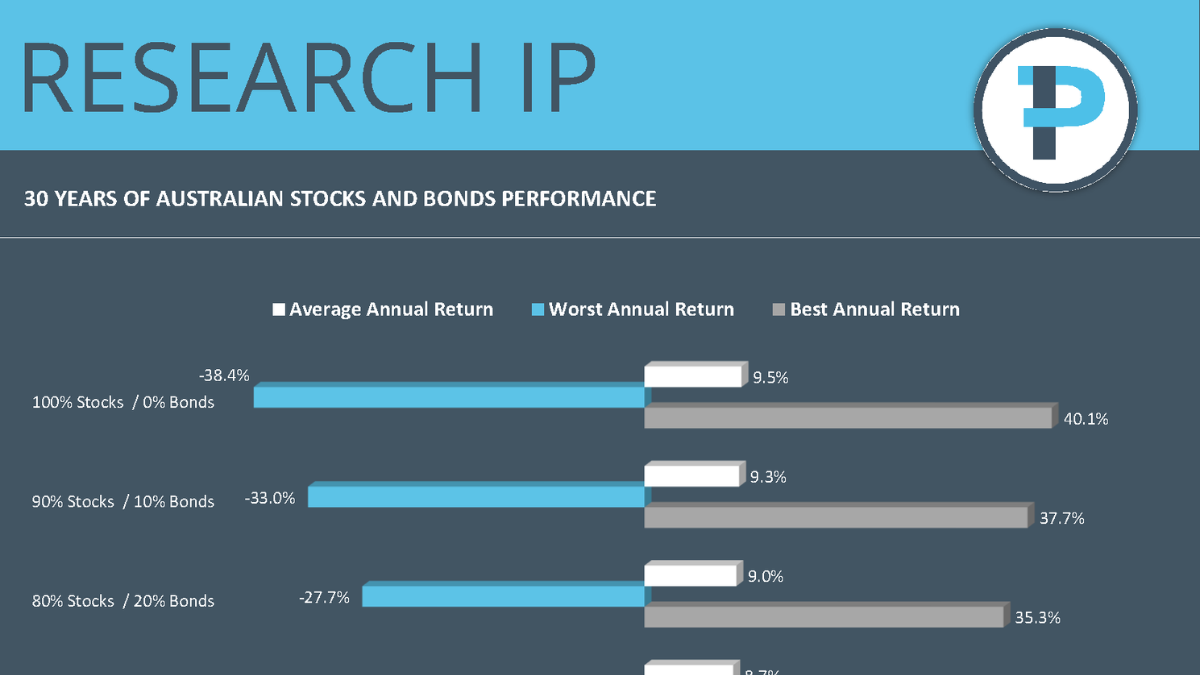

Asset allocation is the main driver of returns over time so this is where much focus should be paid to ensure an investor’s portfolio is commensurate with their risk tolerance. In the last three decades, there have only been two years where both stocks and bonds have returned negative performances in the same year (using Australian index returns). Last year was the first year since 1994 that this has occurred.

Do you want to improve your ESG and Sustainable investing credentials? Research IP has compiled a list of educational resources to help you stand out from the crowd.

Responsible investing has become a focus area in the investment industry, but greenwashing is rife and the sales pitch is strong, so what really matters? Research IP helps many of our consulting clients navigate the maze, but no one client is the same. The monthly RIPPL Sluice provides some examples of responsible investment in action.

Asset allocation is the main driver of returns over time so this is where much focus should be paid to ensure an investor’s portfolio is commensurate with their risk tolerance. In the last 25 years there has only been one year where both stocks and bonds have returned negative performances in the same year (using New Zealand index returns). Last year was the first year this has occurred.

Hopefully, the information within Beneath the Surface of Responsible Investing helps shed some light on this far-reaching topic. Research IP helps many of our consulting clients navigate the maze, but no one client is the same. Over the next few months we hope to share examples, while also continuing to dive deeper into specific areas of this paper. In the meantime, please reach out if you believe we could be of assistance.

The growth in managed funds focused on ESG considerations across the globe has warranted reviews by regulators to assess whether the actual practices of Fund Managers match how the products are promoted. Basically, tackle “greenwashing”. The breadth and depth of disclosure requirements are continually developing and differ across investment jurisdictions. This article gives an insight into recent developments and links for further information.

The RIPPL NZ Leaders highlights some market trends and how funds performed over the last 12 months. Check out the KiwiSaver and Non-KiwiSaver investment performance and accompanying RIPPL Effect reports.

What part does data play in the consideration of ESG issues when investing in managed funds? What are some key aspects to be aware of regarding ESG data? Is it Active, Passive or ETF?

What are the Sustainable Development Goals? What are the investment merits of the SDGs?