Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

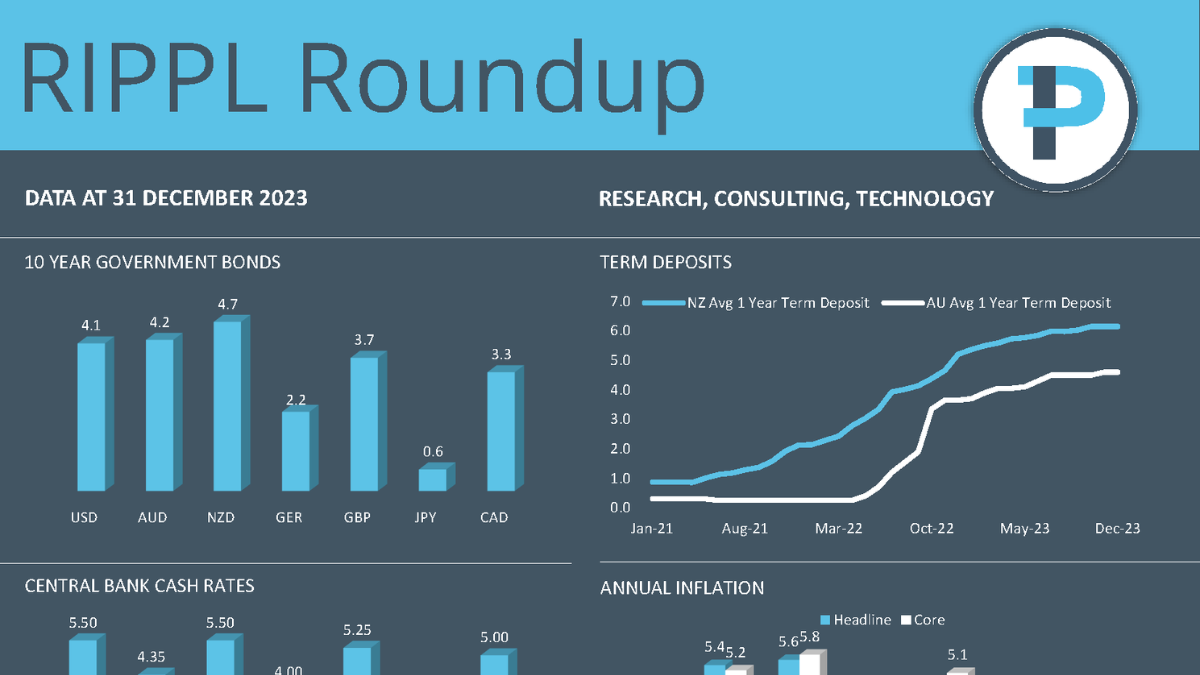

Economic and market highlights for the December Quarter 2023.

Responsible investing has become a focus area in the investment industry, but greenwashing is rife and the sales pitch is strong, so what really matters? Research IP helps many of our consulting clients navigate the maze, but no one client is the same. The monthly RIPPL Sluice provides some examples of responsible investment in action.

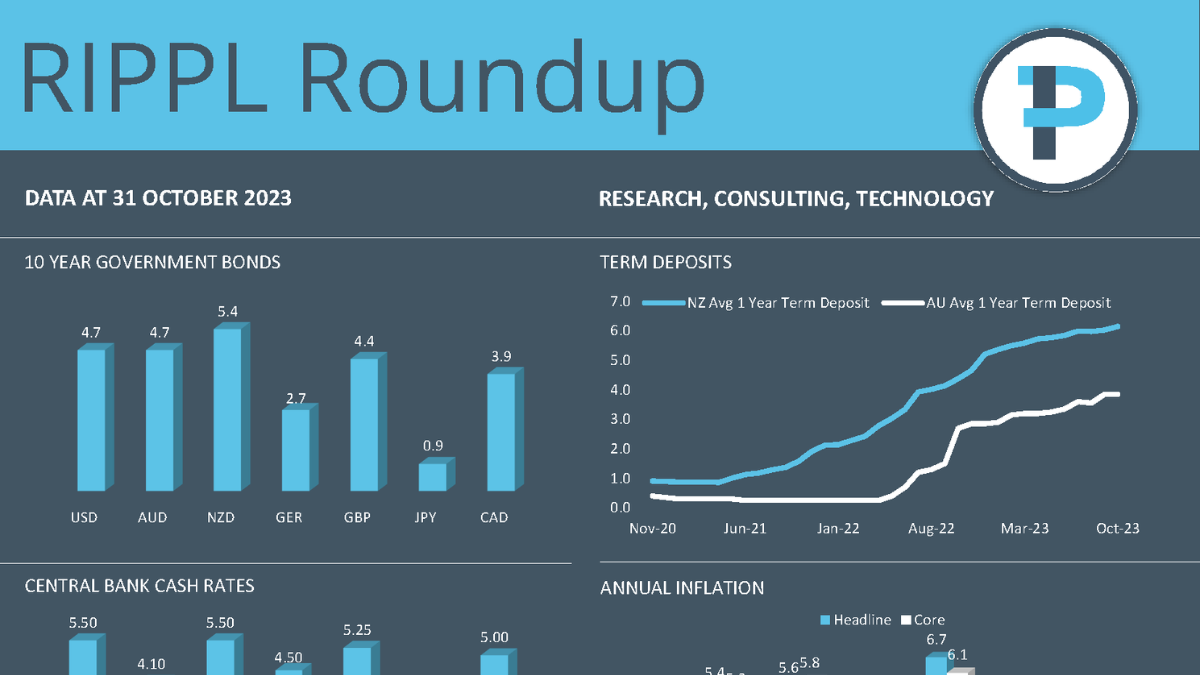

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Responsible investing has become a focus area in the investment industry, but greenwashing is rife and the sales pitch is strong, so what really matters? Research IP helps many of our consulting clients navigate the maze, but no one client is the same. The monthly RIPPL Sluice provides some examples of responsible investment in action.

Congratulations to the team at Milford Asset Management, taking out this year’s coveted Fund Manager of the Year 2023 Award.

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Announcing the finalists for 2023. The Research IP Fund Manager of the Year Awards are back, recognising talent in the world of investment management.

Responsible investing has become a focus area in the investment industry, but greenwashing is rife and the sales pitch is strong, so what really matters? Research IP helps many of our consulting clients navigate the maze, but no one client is the same. The monthly RIPPL Sluice provides some examples of responsible investment in action.

RIPPL Investment Commentary – December Quarter 2023