The 2023 Stress Test Results and the Delinquency Rates from Federal Reserve System, and the report from CoreLogic collectively give a positive insight about the United States financial landscape.

The investment landscape has been influenced by global events and economic trends, including concerns about inflation and interest rates, unexpected post-COVID price surges, and central bank actions. Read our quarterly commentary to learn more.

Real interest rates have rapidly increased recently as monetary policy has tightened in response to higher inflation. Whether this uptick is temporary or partly reflects structural factors is an important question for policymakers.

Before investing in funds with performance fees, it's crucial for investors to thoroughly understand the fee structure, potential investment risks, and the ability of the manager to make informed decisions in line with their mandate.

Constructing an investment portfolio involves careful planning and consideration of various factors to align with your financial goals, risk tolerance, and time horizon. Here are the key steps to follow when creating an investment portfolio.

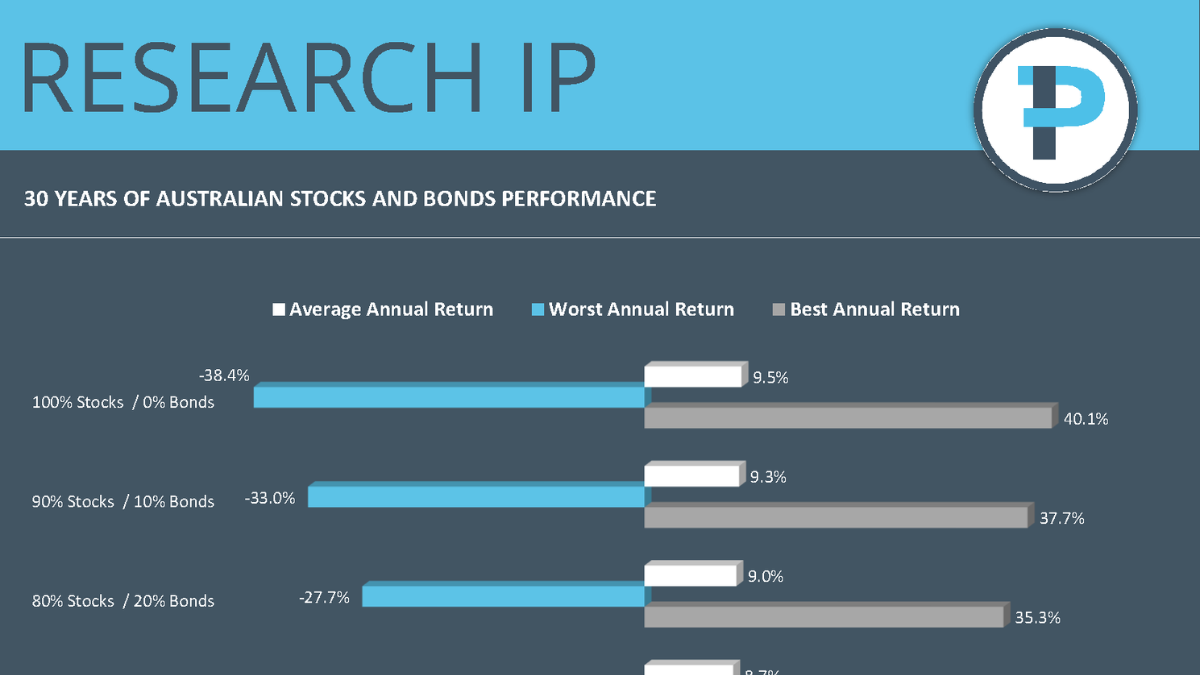

Asset allocation is the main driver of returns over time so this is where much focus should be paid to ensure an investor’s portfolio is commensurate with their risk tolerance. In the last three decades, there have only been two years where both stocks and bonds have returned negative performances in the same year (using Australian index returns). Last year was the first year since 1994 that this has occurred.

Given the ongoing risks posed by inflation to households and businesses, caution is advised. Read the short version of our quarterly commentary to learn more.

Do you want to improve your ESG and Sustainable investing credentials? Research IP has compiled a list of educational resources to help you stand out from the crowd.

Asset allocation is the main driver of returns over time so this is where much focus should be paid to ensure an investor’s portfolio is commensurate with their risk tolerance. In the last 25 years there has only been one year where both stocks and bonds have returned negative performances in the same year (using New Zealand index returns). Last year was the first year this has occurred.

RIPPL Investment Commentary – December Quarter 2023