A data-driven dive into global investing trends, Python’s explosive growth and the surprising psychology behind our financial decisions.

In the world of finance and information overload, knowledge is power. We hope you find the RIPPL Insights for June 2025 useful.

Research IP delivers RIPPL Insights to serve as your monthly go-to source of compiled content in three focus areas – behavioural finance, investment, and technology.

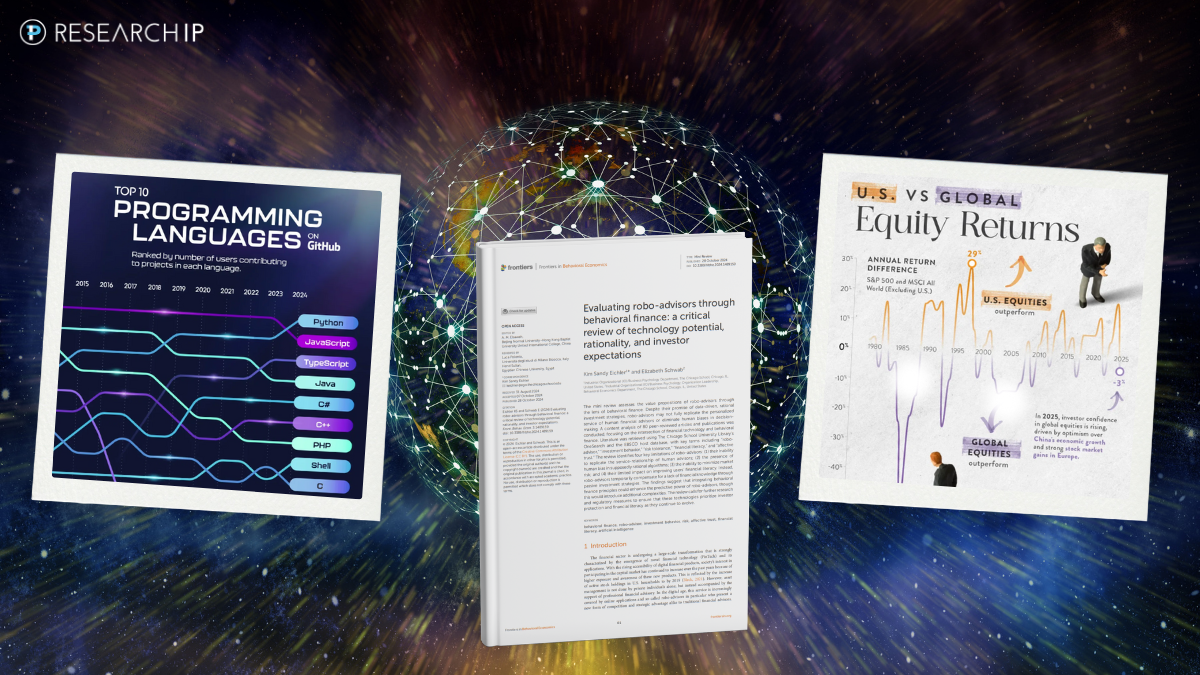

| Python Is Now The Most Popular Programming Language 🖥️1 The most popular programming languages on GitHub from 2014 to 2024, ranked by the number of users contributing to projects in each language. …and Grok will write it for you. #technology READ MORE |

| Evaluating robo-advisers through behavioural finance: a critical review of technology potential, rationality and investor expectations The financial sector is undergoing a large-scale transformation that is strongly characterised by the emergence of novel financial technology (FinTech) and its applications.2 #behaviouralfinance #technology READ MORE |  |

| U.S. vs. Global ex-US Equity Returns Since 1979📈 In 2025, global ex-US equities were outperforming the S&P 500 by 2.7% (as of February 19). Investors are becoming increasingly bullish on global equities, with European stocks seeing the strongest monthly returns against the S&P 500 in January in a decade. Over the past 10 years, global stocks have averaged 4.9% annualised returns while the S&P 500 has averaged 13.8%. 3 #investment READ MORE |

Research IP delivers high-quality investment fund research and consultancy services to financial advisers, charities & NFPs, and the broader financial services industry. Our experience spans well over 20 years working directly across the multiple facets of finance, so we understand the key drivers and challenges for managers, as well as the impact on investors and the broader industry.

We strive to give you the best information, so you can help your clients make better decisions, and feel more confident about doing business with you. We believe that not only can everybody win, but everybody should.

Reach out to us today about your research and consulting needs, and how to make the data work for you and your clients.

Stay updated with our latest news. Sign up for our newsletter.

Would you like to see research on a Managed Fund? Then enquire here.

Credits: Voronoi by Visual Capitalist, 1GitHub, 2Eichler KS and Schwab E (2024) Evaluating robo-advisors through behavioral finance: a critical review of technology potential, rationality, and investor expectations. Front. Behav. Econ. 3:1489159. doi: 10.3389/frbhe.2024.1489159, 3Trading View, Curvo, and geralt from pixabay

Comments are closed