Branding is something that is critically important to a company, with billions of dollars invested to support a company name each year.

With most investors having some exposure to international equities in their portfolio, how many of the companies named in the infographic are you invested in?

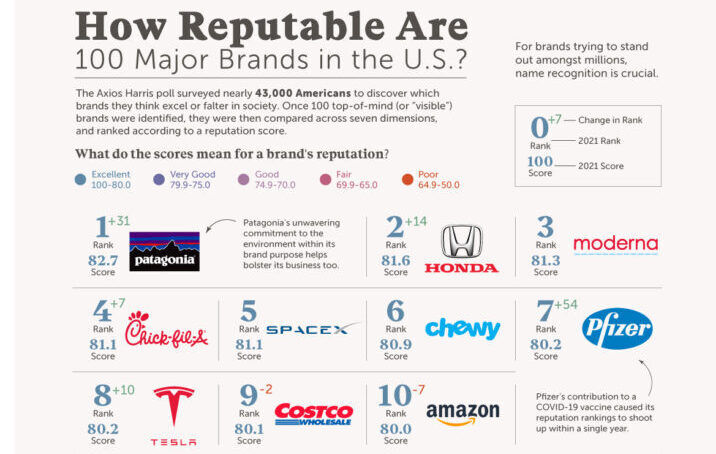

Patagonia climbed from position 32 to be number 1 in 2021. But the fastest growing reputation belonged to Pfizer. Largely due to the COVID-19 vaccine, moving up 54 paces from 61 to number 7. Notably Pfizer was not the highest reputations pharmaceutical company with Moderna ranked in at number 3. How the mighty have fallen, with Google copping a 36 point slide in the ranking falling down to the 60th. Despite this slide down the ranks, Google does not appear in the top performing or worst companies by reputation. Unlike Fox Corporation and Facebook who were both in the bottom 5 for each assessment criteria, Trust, Culture, Ethics, Citizenship, Vision, Growth and Products & Services. These seven aspects were then grouped up to three key pillars, Character, a measure of whether consumers share the companies values or they are perceived to support good causes. Trajectory looks at how innovative and the quality of the company. Lastly is Trust, simply measuring the trust consumers place in the brand.

What does this mean for investors? Reputational change is an increasingly important piece of the puzzle for companies. Gaining a reputation, good or bad, can impact investor sentiment. While reputational risk is considered by institutional investors, retail investors can exert influence on the share price of a company. This has been evident in the US company that wasn’t featuring in professional investment portfolios, other than short sellers. With the power of the retail investor, GameStop not only grew its share price, but has also made its way on to the 2021 Axios Harris Poll 100, meaning it is a company that is on the minds of the US investor. 2020 was amazing year for investments all-round. The companies that have invested heavily in their brand and reputation, can change quickly, with the retail investors flexing some muscle over markets as well. When reviewing fund managers Research IP considers the portfolio and the risks inherent residing in the portfolio, red flags for a company can come from a number or sources, reputation and trust in a company being one of those risks to company valuations.

Research IP delivers high quality investment fund research and consultancy services to financial advisers, charities & NFPs and the broader financial services industry. Our experience spans well over 20 years working directly across the multiple facets of finance, so we understand the key drivers and challenges for managers, as well as the impact for investors and the broader industry.

We strive to give you the best information, so you can help your clients make better decisions, and feel more confident about doing business with you. We believe that not only can everybody win, everybody should.

Reach out to us today about your research and consulting needs, and how to make the data work for you, and your clients.

Would you like to see research on a Managed Fund, then enquire here?

Sources: Visual Capitalist https://www.visualcapitalist.com/ranking-reputation-100-major-brands-us/ & 2021 Axios Harris Poll 100 https://theharrispoll.com/wp-content/uploads/2021/05/Axios-Harris-Poll-100-2021-Report.pdf

Image credit: Visual Capitalist

Comments are closed