The year 2022 saw power systems facing challenges in multiple regions due to extreme weather events such as heatwaves, droughts, and winter storms, resulting in power outages and low hydropower output. This has highlighted the urgent need to increase the flexibility of the power system and enhance the security of electricity supply to better cope with weather-related contingencies.

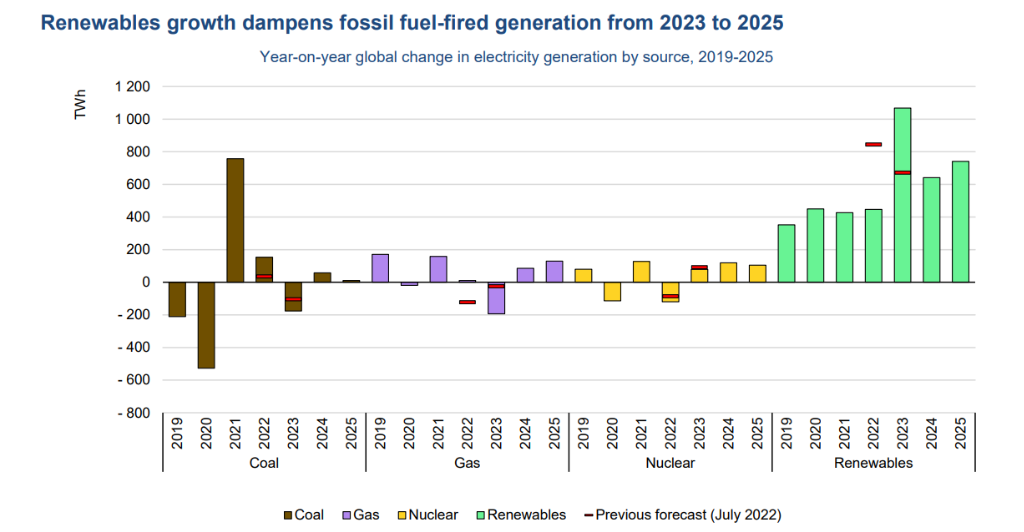

Additionally, the surge in fossil fuel prices following Russia’s invasion of Ukraine compounded the supply situation, leading to a fuel switching wave to coal for power generation. However, global coal-fired generation is forecast to plateau in 2023-2025, with renewable power generation set to increase more than all other sources combined, making up over one-third of the global generation mix by 2025.

Nuclear output is expected to grow by 3.6% per year on average, mainly due to the increase in Asia Pacific, plus French generation returning to normal. As a result, low-carbon generation sources – renewables and nuclear together – are expected to meet on average more than 90% of the additional electricity demand over the next three years, unless developments in the global economy and weather events change the trends in electricity demand and fossil-fired generation.

Read the full Electricity Market Report from the IEA here: Electricity Market Report 2023 – Analysis – IEA

Where to from here?

Research IP currently has over 300 reports for managed funds available in the New Zealand market, as well as a range also available in Australia. The initial coverage also includes all default, balanced and growth KiwiSaver offerings. Coverage of funds and data points is expanding daily.

- You can find our research embedded at the point of sale on the new investment platform Flint Wealth.

- The RIPPL Effect reports are also available on interest.co.nz (announced here The RIPPL Effect – The future starts here – Research IP (research-ip.com)).

Looking for something in particular or have some feedback? Please reach out to one of the RIPPL team

Research IP delivers high quality investment fund research and consultancy services to financial advisers, charities & NFPs and the broader financial services industry. Our experience spans well over 20 years working directly across the multiple facets of finance, so we understand the key drivers and challenges for managers, as well as the impact for investors and the broader industry.

We strive to give you the best information, so you can help your clients make better decisions, and feel more confident about doing business with you. We believe that not only can everybody win, everybody should.

Reach out to us today about your research and consulting needs, and how to make the data work for you, and your clients.

Would you like to see research on a Managed Fund, then enquire here?

Photo credit: International Energy Agency

Comments are closed