We bring you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Our Key Observations:

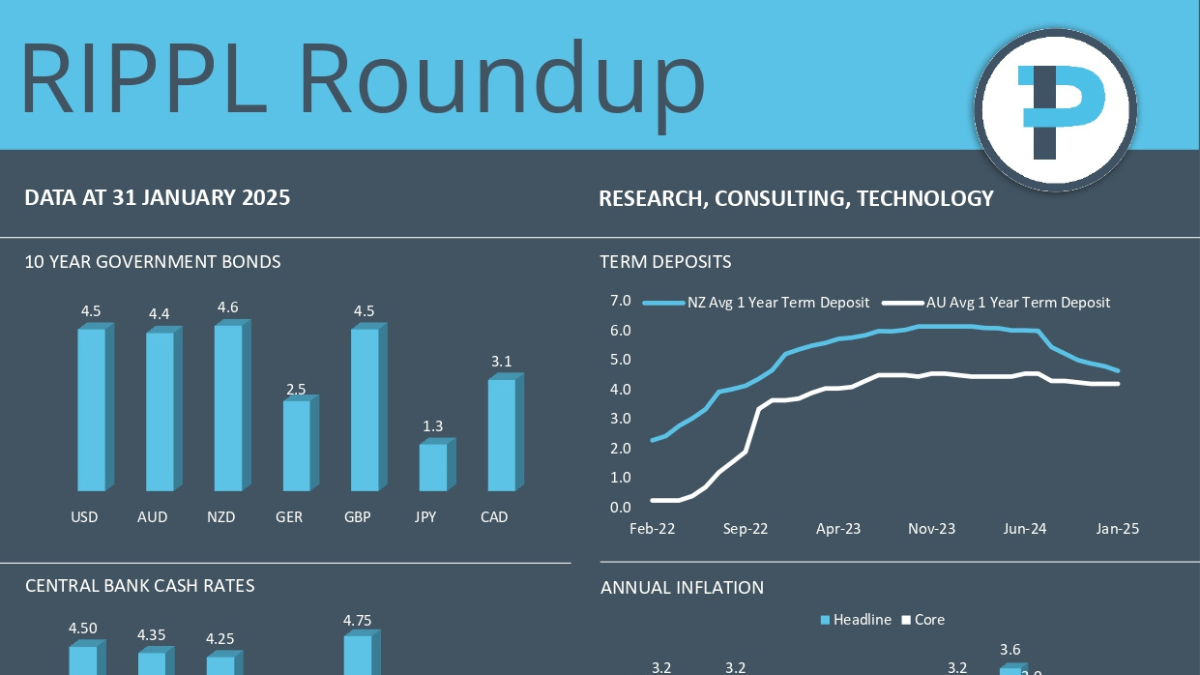

- 10-year Government Bonds increased in New Zealand, Germany, and Japan and fell in the US, UK, and Canada. With Australia remaining flat for the month.

- Central bank cash rates were mostly flat for the month, with the exception of Japan, which increased slightly, and Canada, which fell.

- Headline inflation was static in New Zealand, while the US, UK, and China declined, and Australia, Europe, and Japan. Noticeable Japan increased by 0.70%.

- Core inflation remained static in New Zealand and Europe, while the US, Australia, and UK moved downward. Both Japan and China increased.

- Term deposit rates continue to fall in New Zealand, while Australia has plateaued.

- For the month of January, markets were largely positive, with the exception of the New Zealand Equities and Global Property indices.

Feel free to utilise this update with your clients; all we ask is that you reference Research IP in your communication. We can also supply individual charts as required.

Looking for something in particular or have some feedback? Please reach out to one of the RIPPL team

Research IP delivers high-quality investment fund research and consultancy services to financial advisers, charities & NFPs, and the broader financial services industry.

Our experience spans well over 20 years working directly across the multiple facets of finance, so we understand the key drivers and challenges for managers, as well as the impact on investors and the broader industry.

We strive to give you the best information so you can help your clients make better decisions and feel more confident about doing business with you. We believe that not only can everybody win, but everybody should.

Reach out to us today about your research and consulting needs and how to make the data work for you and your clients.

Stay updated with our latest news. Sign up for our newsletter.

Would you like to see research on a Managed Fund? Then enquire here.

Photo credits: Research IP

Comments are closed