We bring you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Our Key Observations:

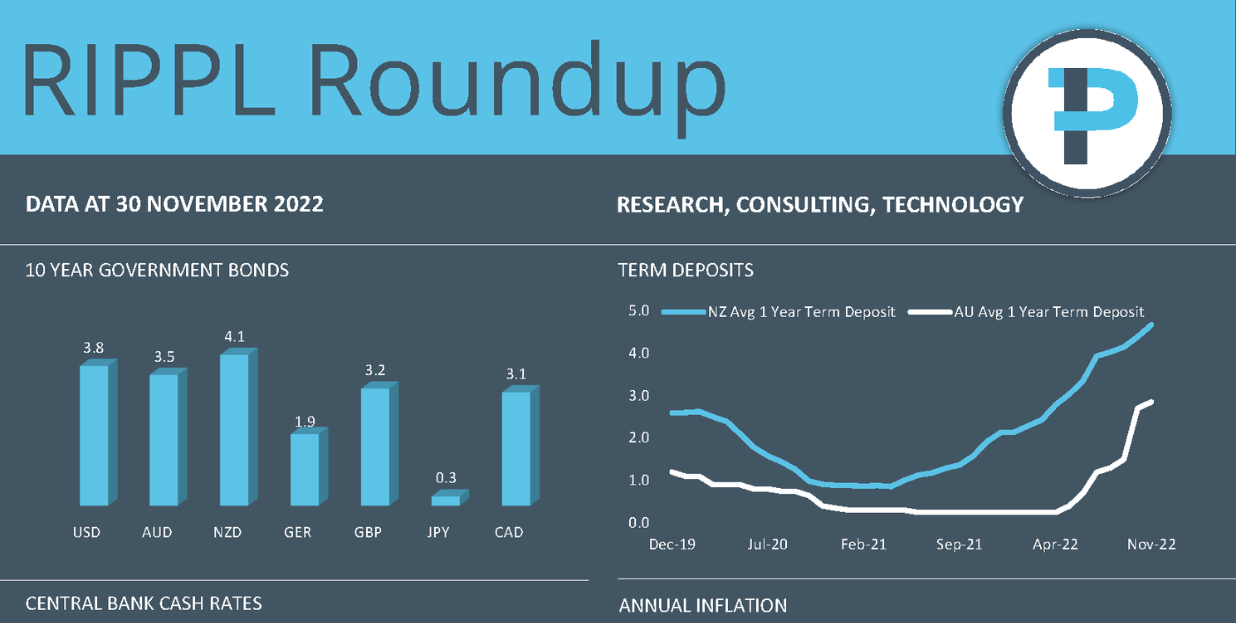

- The central bank cash rates in the US, NZ, and Canada are higher than the relevant government 10 year bond yield.

- Over the last 12 months, the NASDAQ is the only index with a worse return than the Bloomberg Global Agg. Bond index.

- Aside from cash, only Australian equities and commodities made positive returns over 12 months.

- November saw are broad bounce in returns across multiple asset classes.

- Both the AUD and NZD strengthened against the USD over the month as the US Fed signalled smaller future rate hikes.

Feel free to utilise this update with your clients, all we ask is that you reference Research IP in your communication. We can also supply individual charts as required.

Looking for something in particular or have some feedback? Please reach out to one of the RIPPL team

Research IP delivers high quality investment fund research and consultancy services to financial advisers, charities & NFPs and the broader financial services industry. Our experience spans well over 20 years working directly across the multiple facets of finance, so we understand the key drivers and challenges for managers, as well as the impact for investors and the broader industry.

We strive to give you the best information, so you can help your clients make better decisions, and feel more confident about doing business with you. We believe that not only can everybody win, everybody should.

Reach out to us today about your research and consulting needs, and how to make the data work for you, and your clients.

Would you like to see research on a Managed Fund, then enquire here?

Photo credit: Research IP

Comments are closed