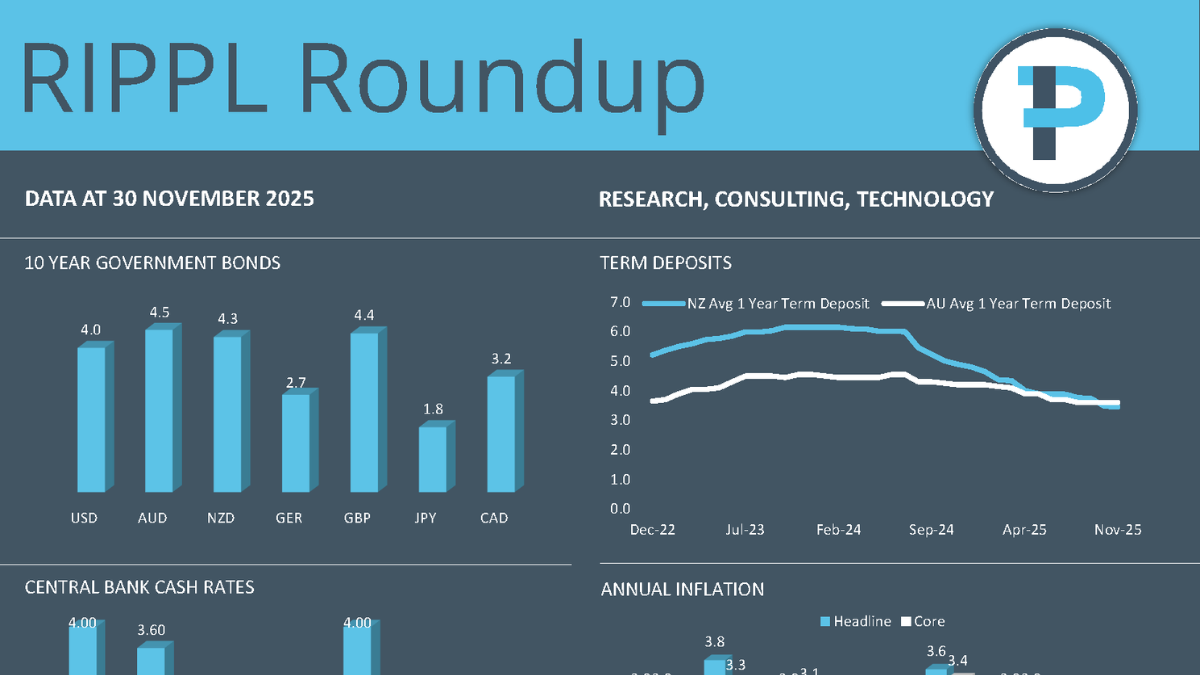

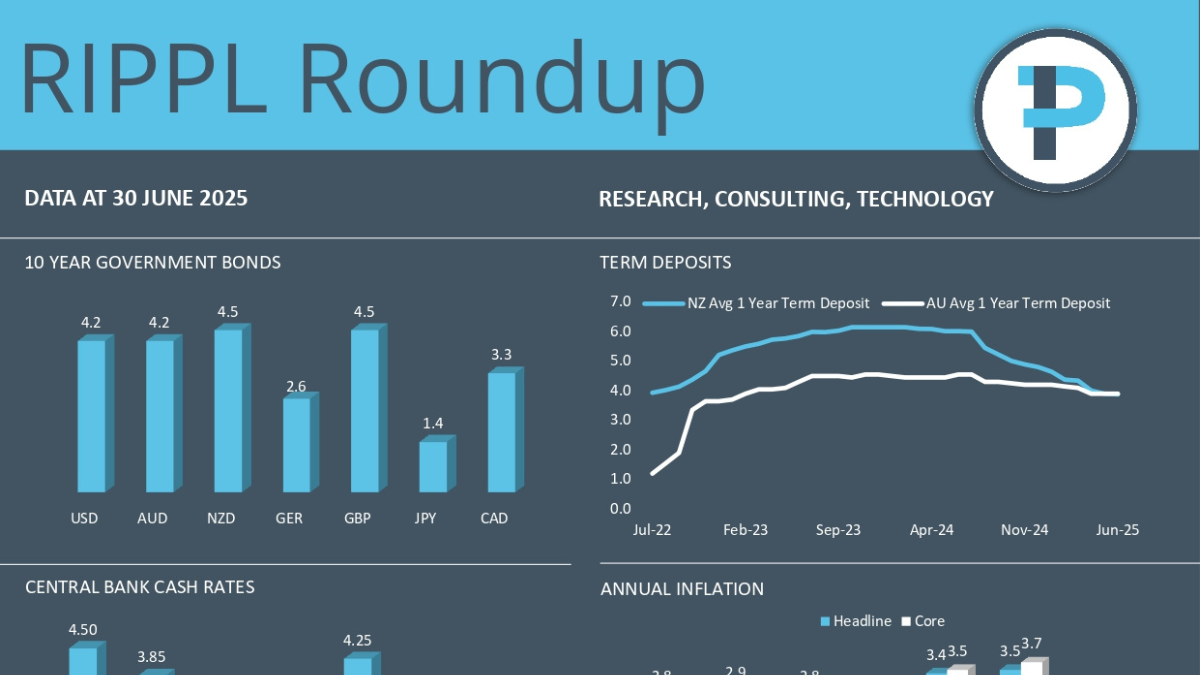

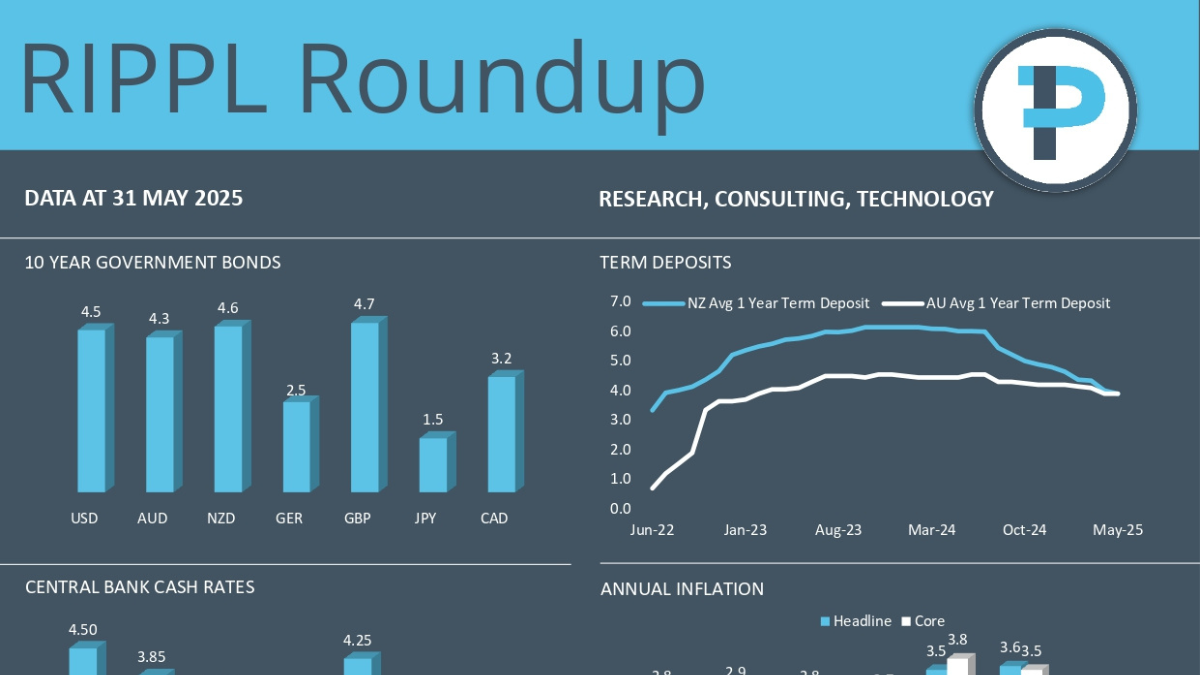

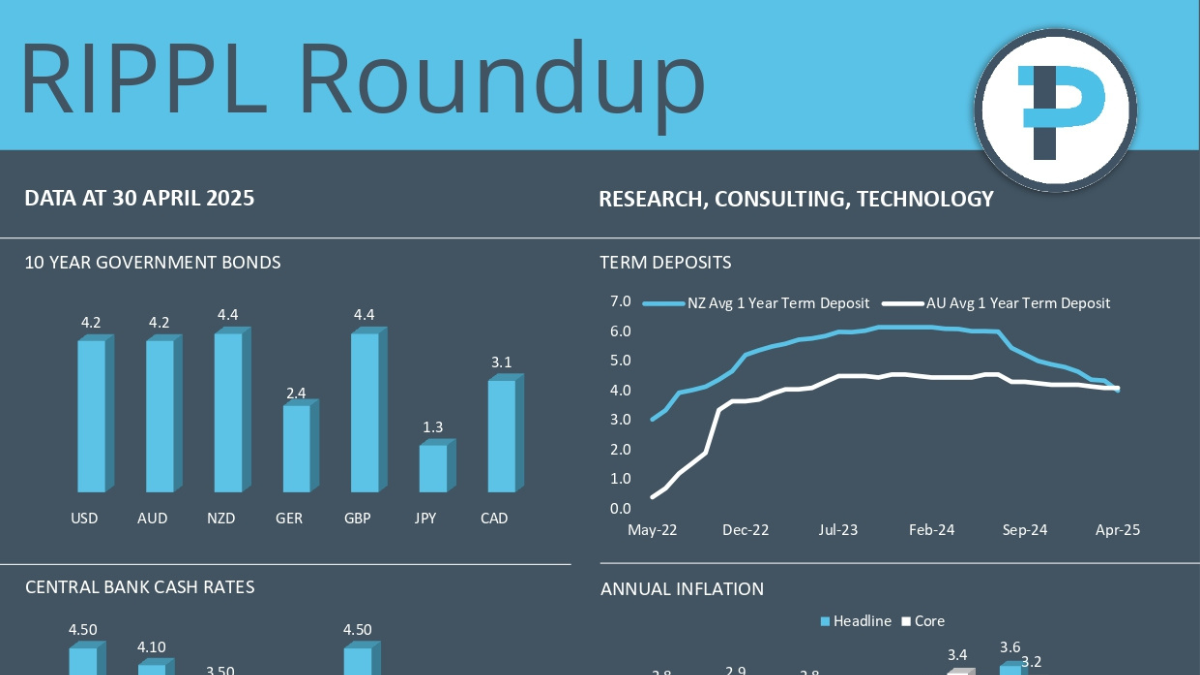

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

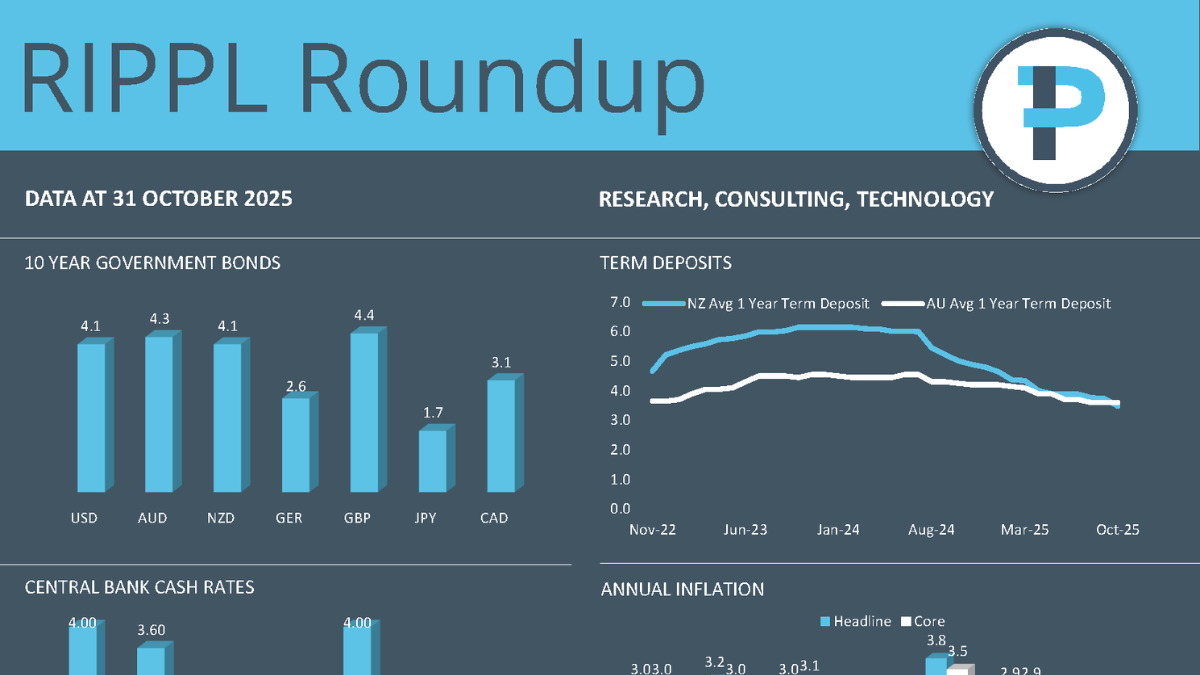

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

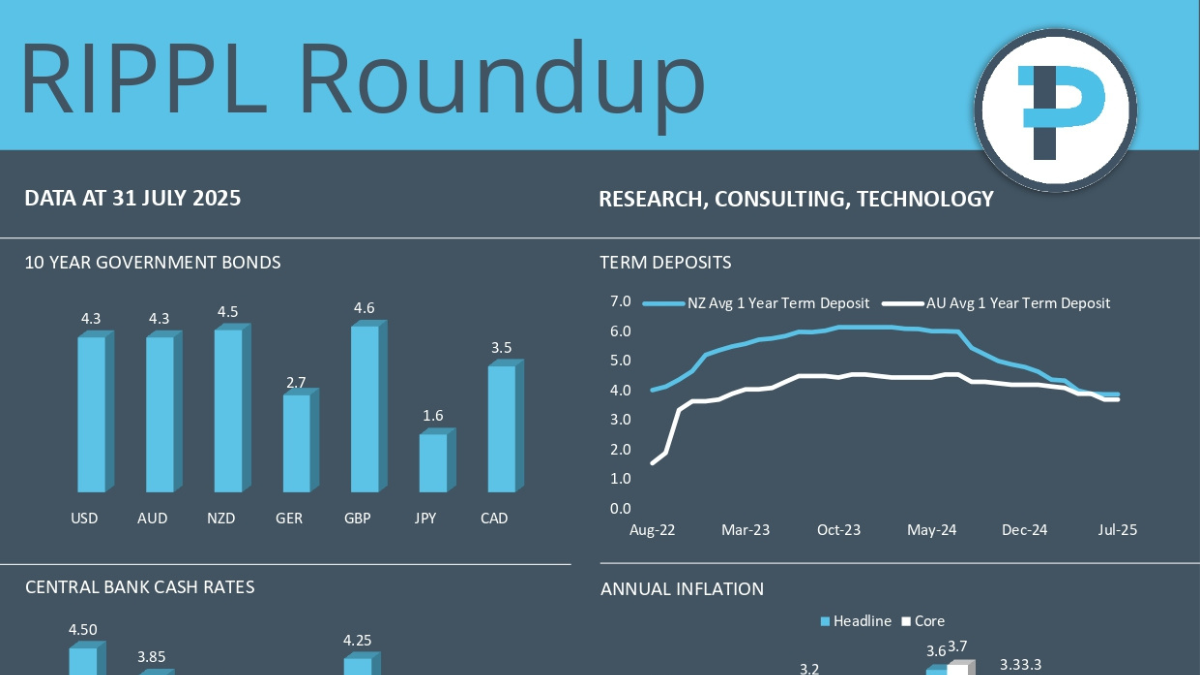

The first quarter of 2025 has presented a complex economic landscape across major global economies, influenced by factors such as trade tensions, inflationary pressures, and varying growth trajectories.

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

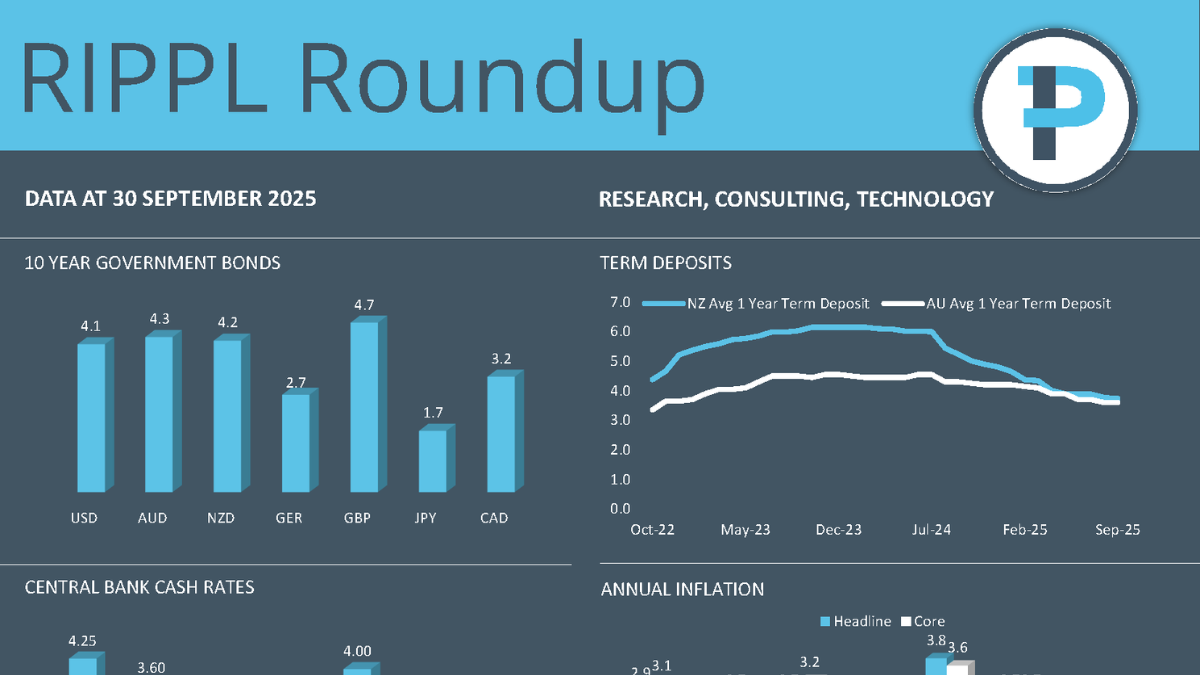

RIPPL Investment Commentary — September Quarter 2025