Responsible investing has become a focus area in the investment industry, but greenwashing is rife and the sales pitch is strong, so what really matters? Research IP helps many of our consulting clients navigate the maze, but no one client is the same. The monthly RIPPL Sluice provides some examples of responsible investment in action.

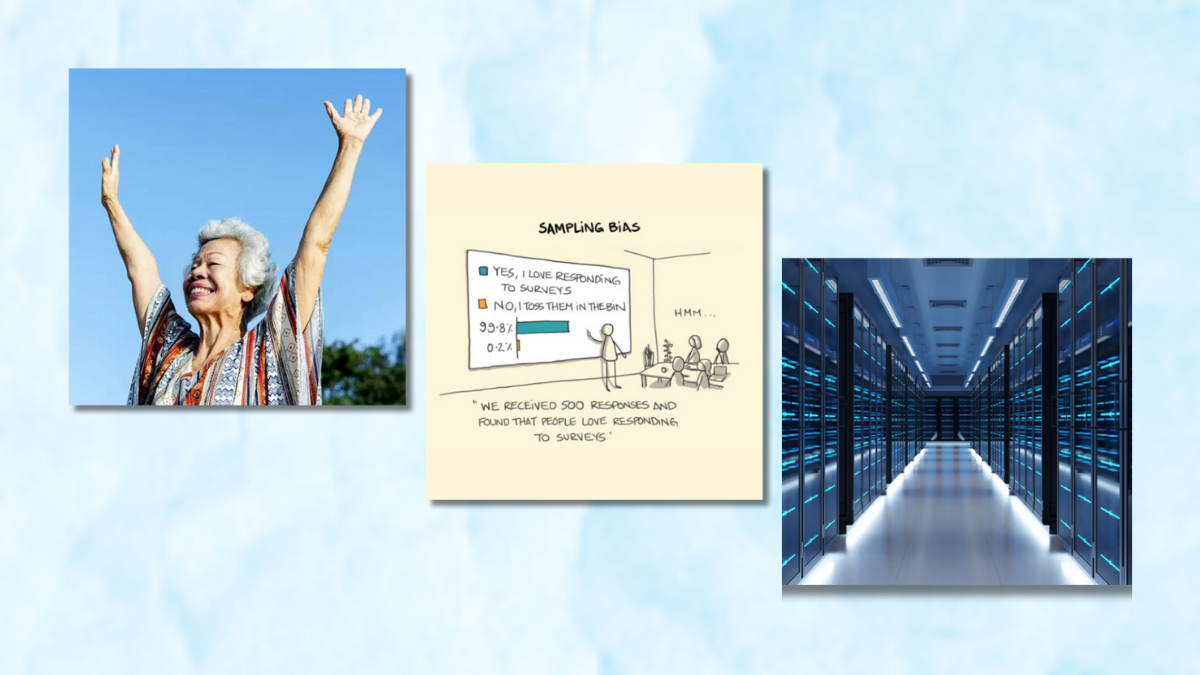

In the world of finance and information overload, knowledge is power. Research IP delivers RIPPL Insights to serve as your monthly go-to source of compiled content in three focus areas - behavioral finance, technology, and investment.

Responsible investing has become a focus area in the investment industry, but greenwashing is rife and the sales pitch is strong, so what really matters? Research IP helps many of our consulting clients navigate the maze, but no one client is the same. The monthly RIPPL Sluice provides some examples of responsible investment in action.

In the world of finance and information overload, knowledge is power. Research IP delivers RIPPL Insights to serve as your monthly go-to source of compiled content in three focus areas - behavioral finance, technology, and investment.

In the world of finance and information overload, knowledge is power. Research IP delivers RIPPL Insights to serve as your monthly go-to source of compiled content in three focus areas - behavioral finance, technology, and investment.

In the world of finance and information overload, knowledge is power. Research IP delivers RIPPL Insights to serve as your monthly go-to source of compiled content in three focus areas - behavioral finance, technology, and investment.

The Ausbil Global SmallCap Fund has retained a "4 IP" rating from Research IP, with a score of 4.20/5.

In the world of finance and information overload, knowledge is power. Research IP delivers RIPPL Insights to serve as your monthly go-to source of compiled content in three focus areas - behavioral finance, technology, and investment.

The Massachusetts Investors Trust was the first open-end mutual fund, meaning it allowed investors to buy in or sell out at the net asset value of the shares, which was calculated daily. This feature differentiated it from closed-end funds, making it far more accessible and flexible for individual investors.