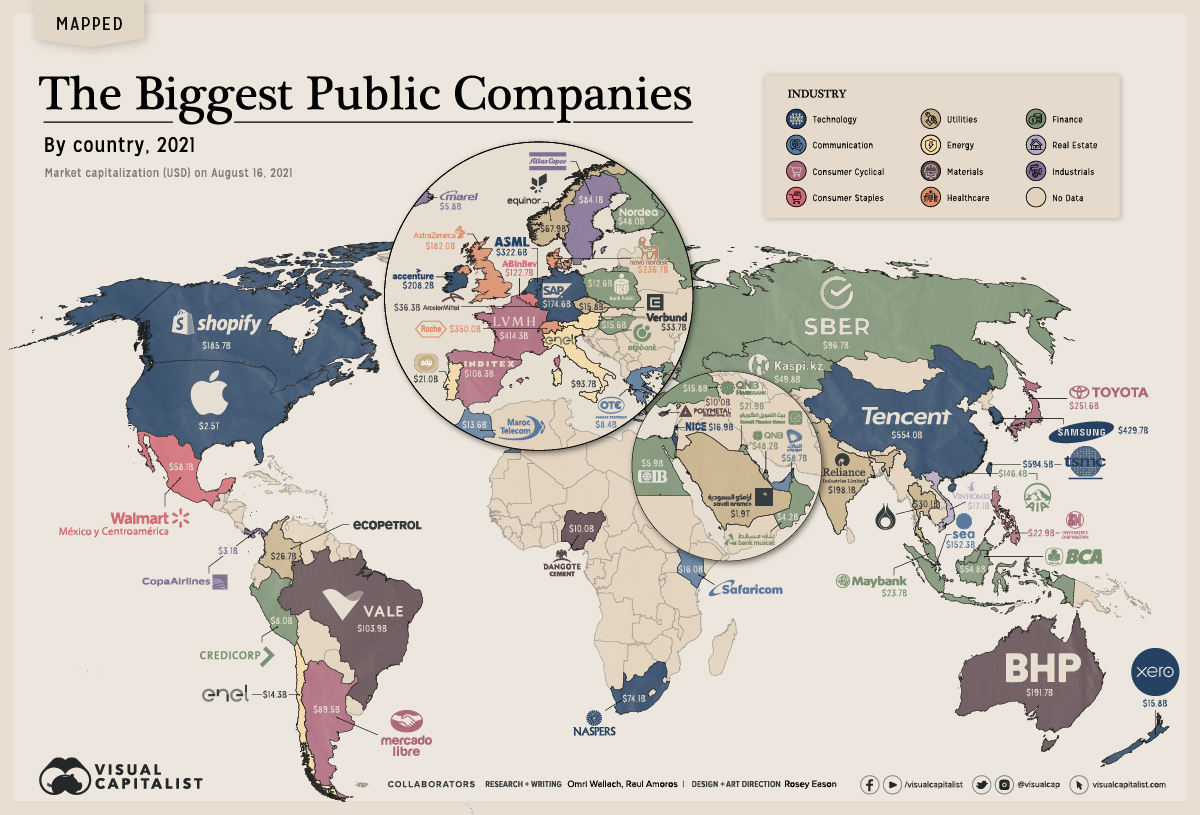

A quick whip around the world looks to identify the biggest companies for each country. Noticeably, there is a clear separation between new and old economy, this can be seen between Australia (BHP, old economy resources company) and New Zealand (Xero, technology enabler).

One thing is for sure, the list will not remain static over time.

Looking at the infographic, the world has 60+ stock exchanges, and each one has a top company (largest local company, since many of the world’s largest firms trade on multiple exchanges, and converted market cap to USD).

In a world where index-based passive investing has grown significantly over the past decade, to dominate fund inflows, this isn’t a representative basket of securities or index you can invest in yet! Although the proliferation of index based products being released may see that change.

Other than having an interesting infographic to look at, we aim to shed some light on how a very simple set of rules, overlayed with a process, can lead to a new investment product being constructed. An investment strategy that sounds plausible.

As a financial product, how would this reference basket look compared to the Australian Stock Exchange and the MSCI All Countries World Index (ACWI)? In short, there is a significant difference between the sector weights of the Infographic portfolio versus the MSCI ACWI, at least when it comes to the big sectors of technology and financials (each Sector name has been ranked in order of its allocation weight).

| Infographic Sector | Infographic Sector Breakdown (stock numbers) | MSCI ACWI Index Industry | MSCI ACWI Sector Breakdown (% weight) | ASX Sector | ASX Sector Breakdown (% weight) |

| Financials | 16 | Information Technology | 23 | Financial Services | 29 |

| Technology | 12 | Financials | 14 | Basic Materials | 17 |

| Energy | 6 | Consumer Discretionary | 12 | Healthcare | 11 |

| Materials | 5 | Health Care | 12 | Consumer Cyclical | 9 |

| Communication | 4 | Industrials | 10 | Industrials | 8 |

| Consumer Cyclical | 4 | Communication Services | 9 | Real Estate | 7 |

| Utilities | 4 | Consumer Staples | 7 | Communication Services | 5 |

| Healthcare | 3 | Materials | 5 | Technology | 5 |

| Industrials | 3 | Energy | 3 | Consumer Defensive | 5 |

| Consumer Staples | 2 | Utilities | 3 | Energy | 3 |

| Real Estate | 1 | Real Estate | 3 | Utilities | 2 |

| 60 | 100% | 100% |

Given each of the above propositions could be created as an index investment option, the performance experience would likely be significantly different. This is because the weight to each sector is different, in some cases significantly different. Technology is a part of the world’s growth engine, the MSCI ACWI, but a small proportion of local bourses like Australia.

What does this mean for investors? Ultimately, be aware of what you are investing in and do a little bit of work to ensure the “product” meets your needs and objectives.

Research IP delivers high quality investment fund research and consultancy services to financial advisers, charities & NFPs and the broader financial services industry. Our experience spans well over 20 years working directly across the multiple facets of finance, so we understand the key drivers and challenges for managers, as well as the impact for investors and the broader industry.

We strive to give you the best information, so you can help your clients make better decisions, and feel more confident about doing business with you. We believe that not only can everybody win, everybody should.

Reach out to us today about your research and consulting needs, and how to make the data work for you, and your clients.

Would you like to see research on a Managed Fund, then enquire here?

Sources: Visual Capitalist https://www.visualcapitalist.com/mapping-the-biggest-companies-by-market-cap-in-60-countries

Image credit: Visual Capitalist

Comments are closed