If you haven’t heard ESG (Environmental, Social and Governance) is a thing! Over the course of the past 5 years, it has been growing as a thematic, to the point that Research IP believes there is a fundamental change occurring in financial markets.

Research IP believes the composition of share markets around the world are changing as Responsible Investing grows in importance. Companies that don’t rank well on ESG criteria are increasingly seeking capital from private markets. This leads to companies with lower quality ESG rankings divesting assets to improve ESG rankings and/or selling to private capital firms. As stock exchanges clean up from an ESG perspective, private capital is funding the capital needs of other companies.

Sovereign wealth funds and pension funding systems around the world are pushing through the change on behalf of their representative members. Where capital goes, companies and fund managers have to follow, or risk losing investment.

The CEOs of companies listed on stock exchanges are increasingly disclosing their ESG credentials. Signing up to bodies such as the UN PRI, or incorporating the SDGs (Sustainable Development Goals), is increasing as companies need to align their activities to recognised arbiters of credibility. Fund managers across bonds and equity strategies also have to incorporate credibility to the funds they are managing to remain relevant for large institutional investments and increasingly retail investors.

The growth of ESG based thinking continues and increasingly spans active and passive strategies. The number of ESG based indices grew by 40% between 2019 and 2020.

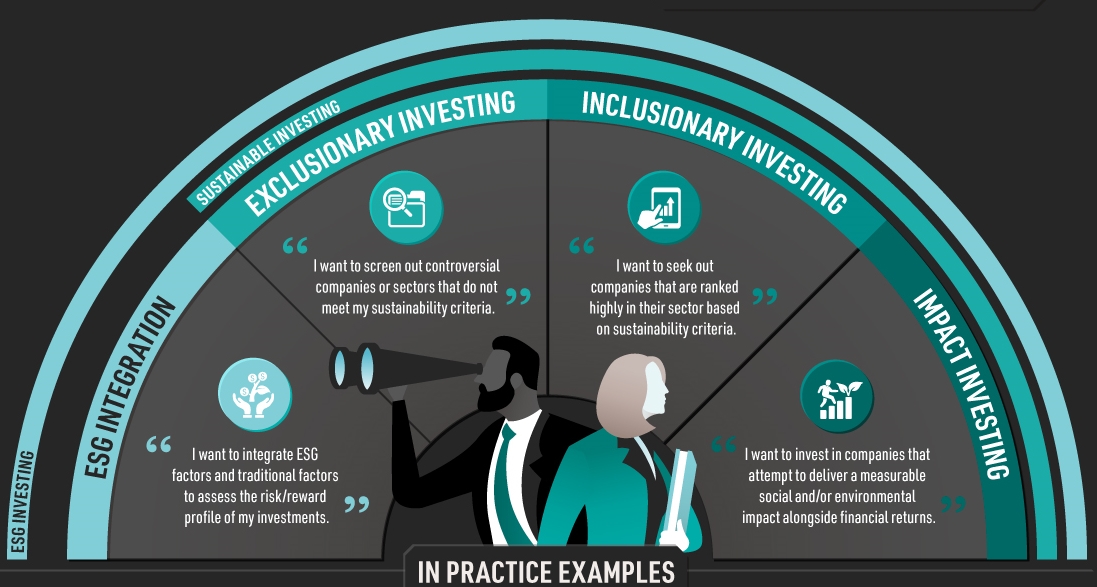

So how does this all relate to the infographic? Do you know what type of investor you are? This Visual Capitalist infographic shows four ways ESG is being thought about, but that doesn’t mean they are the only four ways to look at ESG. Understanding how ESG factors impact investment decisions, and the inclusions and exclusions that comprise a portfolio is important. A better understanding of your investments should help align them with your personal beliefs.

Research IP delivers high quality investment fund research and consultancy services to financial advisers, charities & NFPs and the broader financial services industry. Our experience spans well over 20 years working directly across the multiple facets of finance, so we understand the key drivers and challenges for managers, as well as the impact for investors and the broader industry.

We strive to give you the best information, so you can help your clients make better decisions, and feel more confident about doing business with you. We believe that not only can everybody win, everybody should.

Reach out to us today about your research and consulting needs, and how to make the data work for you, and your clients.

Would you like to see research on a Managed Fund, then enquire here?

Photo credit: Four Types of ESG Strategies for Investors – Advisor Channel (visualcapitalist.com)

Comments are closed