The RIPPL NZ Leaders highlights some market trends and how funds performed over the last 12 months. Check out the KiwiSaver and Non-KiwiSaver investment performance and accompanying RIPPL Effect reports.

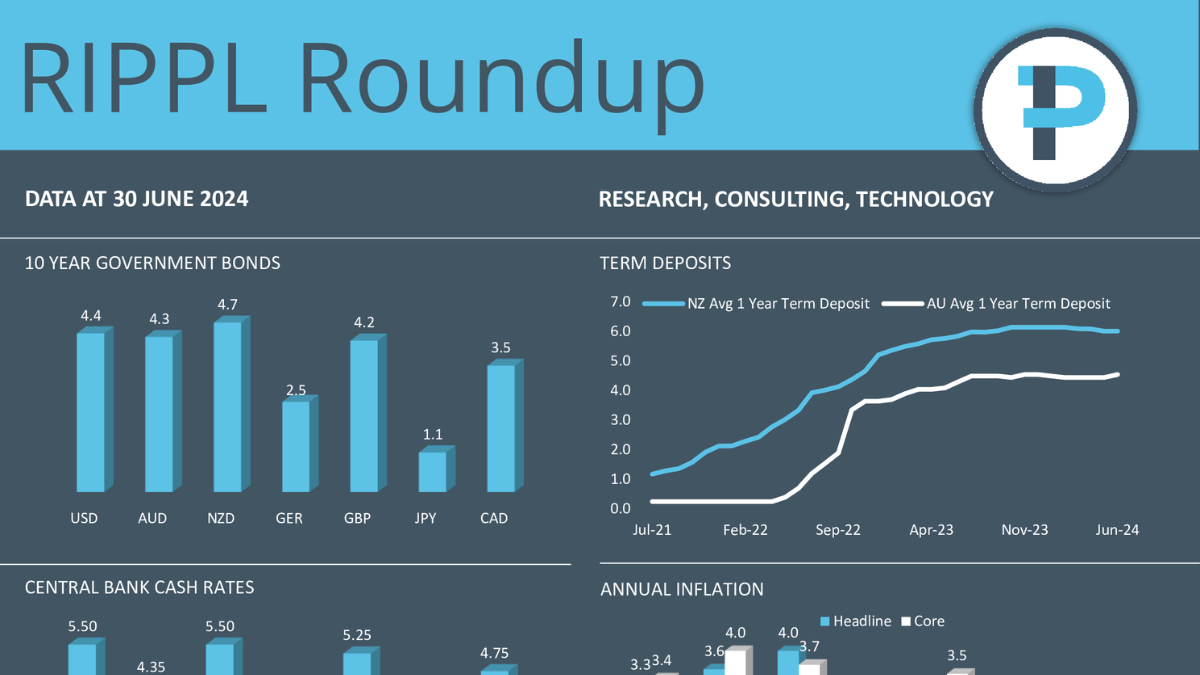

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

In the world of finance and information overload, knowledge is power. Research IP delivers RIPPL Insights to serve as your monthly go-to source of compiled content in three focus areas - behavioral finance, technology, and investment.

Responsible investing has become a focus area in the investment industry, but greenwashing is rife and the sales pitch is strong, so what really matters? Research IP helps many of our consulting clients navigate the maze, but no one client is the same. The monthly RIPPL Sluice provides some examples of responsible investment in action.

The RIPPL NZ Leaders highlights some market trends and how funds performed over the last 12 months. Check out the KiwiSaver and Non-KiwiSaver investment performance and accompanying RIPPL Effect reports.

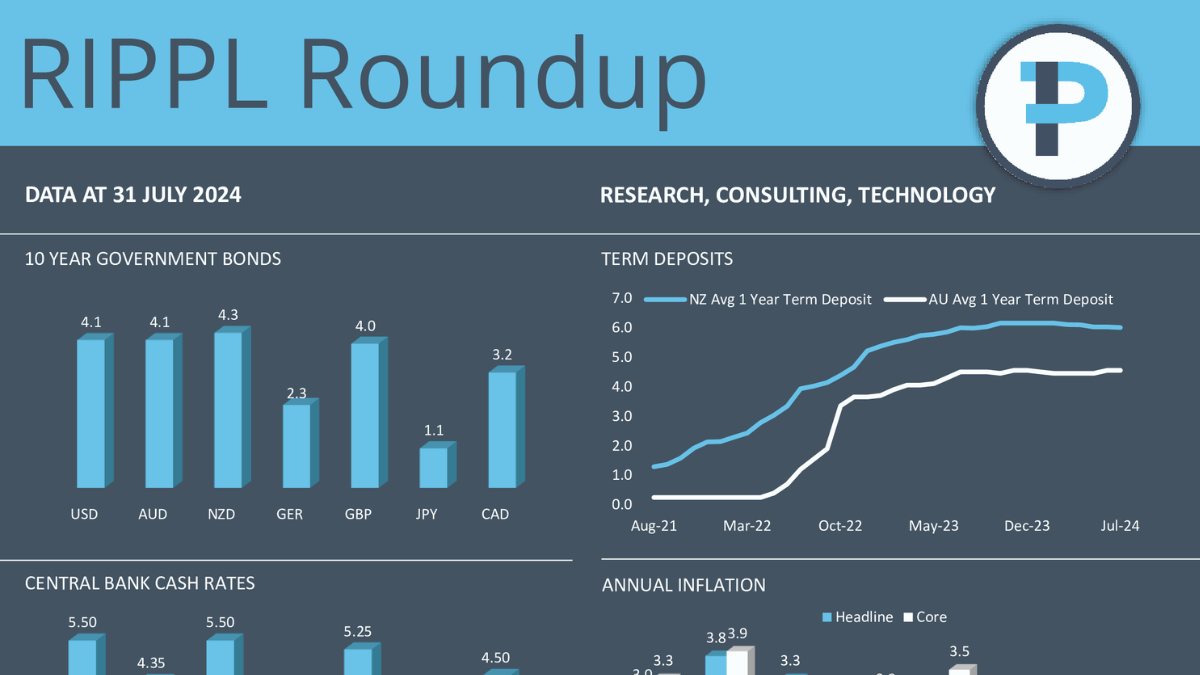

Research IP brings you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

In the world of finance and information overload, knowledge is power. Research IP delivers RIPPL Insights to serve as your monthly go-to source of compiled content in three focus areas - behavioral finance, technology, and investment.

The Candriam Sustainable Global Equity Fund has retained a "5 IP" rating from Research IP, with a score of 4.32/5. The current rating will remain unchanged.

RIPPL Investment Commentary – June Quarter 2024