We bring you the RIPPL Roundup each month to provide an early market snapshot for New Zealand and Australian financial advisers.

Our Key Observations:

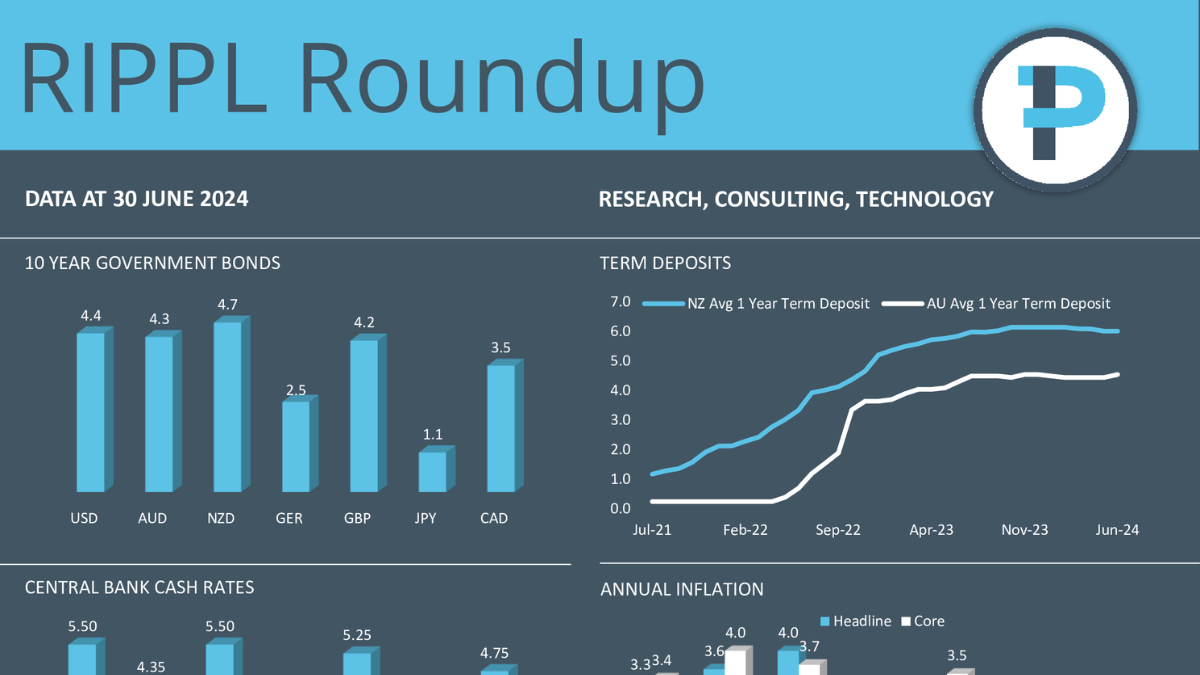

- 10-year Government Bonds saw modest change, with US, UK, Japan, and Canada flat for the month, Australia and New Zealand increased by 0.1%, and Germany fell by 0.1%.

- Central bank cash rates remained steady for the month, except for Europe and Canada, which both reduced by 0.25%.

- Inflation remained steady in Australia and New Zealand, while the US and Japan both fell across both Headline and Core Inflation. Headline inflation remained static in China and increased in Japan. Core inflation increased in Japan and fell in the UK and China.

- Term deposit rates continue to remain flat in Australia and New Zealand.

- From a market’s perspective, all markets, other than the NZX50 and Infrastructure, were positive for the month to June 30, 2024. The NZX50 is the only market that is negative for the year to June 30, 2024.

- The NZD/ USD relationship is negative for the month and over one year. While the AUD/ USD has been positive over both periods.

Feel free to utilise this update with your clients, all we ask is that you reference Research IP in your communication. We can also supply individual charts as required.

Looking for something in particular or have some feedback? Please reach out to one of the RIPPL team

Research IP delivers high quality investment fund research and consultancy services to financial advisers, charities & NFPs, and the broader financial services industry.

Our experience spans well over 20 years working directly across the multiple facets of finance, so we understand the key drivers and challenges for managers, as well as the impact on investors and the broader industry.

We strive to give you the best information, so you can help your clients make better decisions, and feel more confident about doing business with you. We believe that not only can everybody win, but everybody should.

Reach out to us today about your research and consulting needs, and how to make the data work for you, and your clients.

Stay updated with our latest news. Sign up for our newsletter.

Would you like to see research on a Managed Fund? Then enquire here.

Photo credits: Research IP

Comments are closed