Responsible investing has become a focus area in the investment industry, but greenwashing is rife and the sales pitch is strong, so what really matters? Research IP helps many of our consulting clients navigate the maze, but no one client is the same. The monthly RIPPL Sluice provides some examples of responsible investment in action.

Constructing an investment portfolio involves careful planning and consideration of various factors to align with your financial goals, risk tolerance, and time horizon. Here are the key steps to follow when creating an investment portfolio.

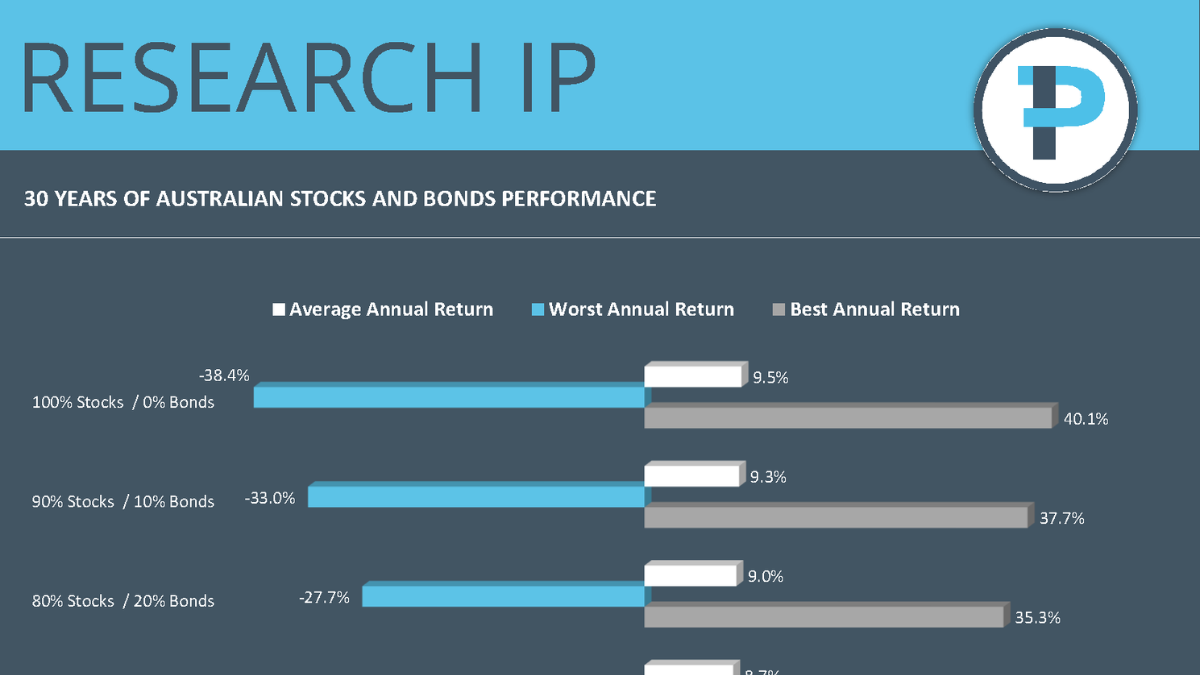

Asset allocation is the main driver of returns over time so this is where much focus should be paid to ensure an investor’s portfolio is commensurate with their risk tolerance. In the last three decades, there have only been two years where both stocks and bonds have returned negative performances in the same year (using Australian index returns). Last year was the first year since 1994 that this has occurred.

Asset allocation is the main driver of returns over time so this is where much focus should be paid to ensure an investor’s portfolio is commensurate with their risk tolerance. In the last 25 years there has only been one year where both stocks and bonds have returned negative performances in the same year (using New Zealand index returns). Last year was the first year this has occurred.

Sequencing risk, or "sequence of returns risk", refers to the potential impact of the order in which returns are received on the overall performance of an investment portfolio. When markets fluctuate more widely, the timing and order of returns are of more concern, particularly for investors that have liquidity needs from their portfolios.

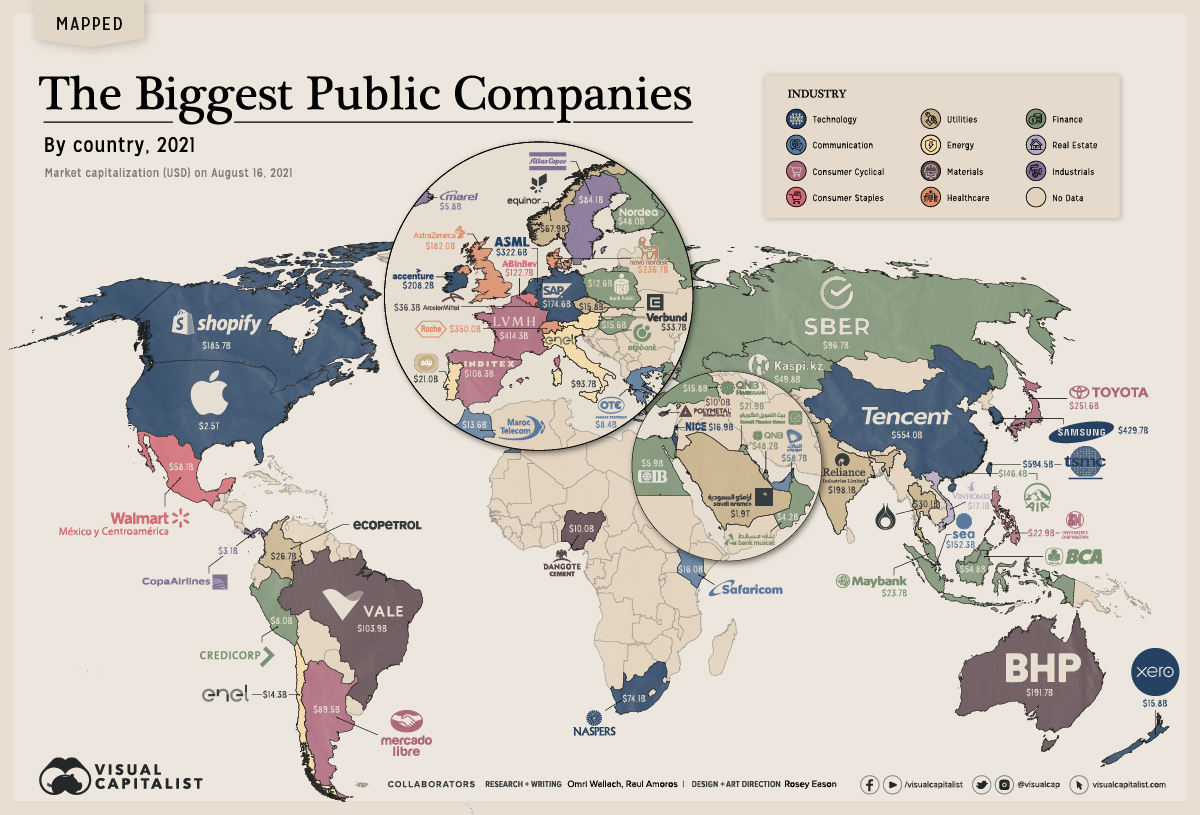

Tech and financials dominate, but does a passive product meet your needs and objectives.