From the 1964 song, Feeling Good by Leslie Bricusse and Anthony Newley:

Birds flying high you know how I feel

Sun in the sky you know how I feel

Breeze driftin’ on by you know how I feel

It’s a new dawn

It’s a new day

It’s a new life for me

And I’m feeling good

Do you feel good about 2022? What is it going to bring?

The early pacesetter is the Omicron variant of COVID-19, ripping up the charts, in a not so positive way, but while the pandemic is potentially moving to an endemic phase (let’s wait and see I guess), the world continues its march forward.

Aspirational goals and settings have been made over the new year, not only by us individually, but as family units, and by our governments. Carbon neutrality and the push to 2050 have come from December, no more ICE vehicles being made available for sale in the UK by 2030.

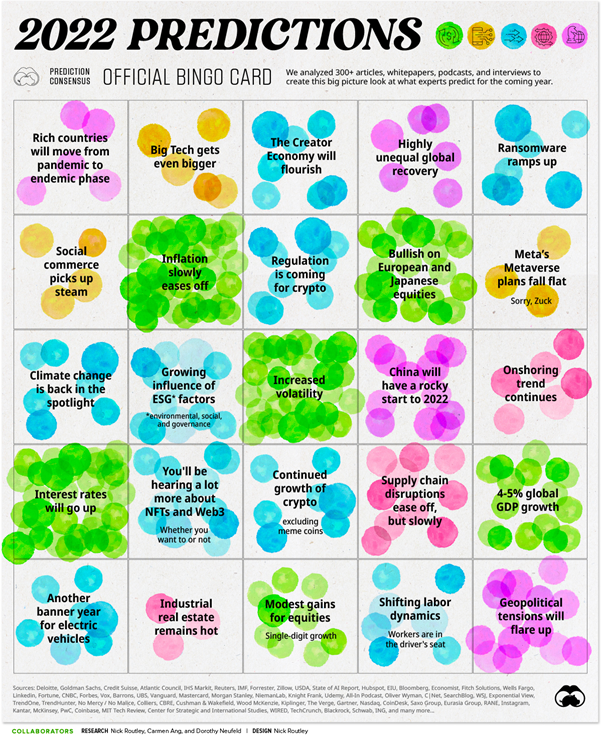

The Visual Capitalist infographic above highlights the key points collated from a number of sources, over 300 articles, whitepapers, podcasts, and interviews. The more stamp marks in a box represents the number of times that point was made. For example, more people have expressed a 2022 view that inflation will slowly ease off, compared to a smaller number of people believing that ransomware will increase over 2022. Arguably some of the more interesting predictions relate to GDP growth tipped to come in at 4-5%. This is interesting given Omicron is arguably disrupting many aspects that would fuel growth, logistics management of fast-moving consumer goods (FMCG), onshoring versus offshoring (which will have winners and losers on a per country basis). There may be some revisions coming to the GDP outlook, but heck we could be wrong as well.

“There is no reason for any individual to have a computer in his home.” Ken Olson, president, chairman and founder of Digital Equipment Corporation (DEC), in a talk given to a 1977 World Future Society meeting in Boston.

It’s not like he would be the first to be wrong 😊

Importantly, the infographic highlights the different views that strategists and analysts around the world are thinking about. What will shape portfolio performance over the course of 2022? Some are positive contributors; some are neutral, and some have a negative effect. We at Research IP believe that volatility will increase as investors, both retail and professional, make decisions based on what they see. Or what they do not see, as was the case with the 2021 stock that wasn’t on anyone’s radar, Gamestop. If there is a time where active funds management should be coming to the fore it is 2022.

If active fund managers want to continue to charge a premium fee for managing investors’ money in an asset class, now is the time to do it. We challenge active fund managers to step up to the plate and show their wares to the world and how they add value over and above indices.

Research IP delivers high quality investment fund research and consultancy services to financial advisers, charities & NFPs and the broader financial services industry. Our experience spans well over 20 years working directly across the multiple facets of finance, so we understand the key drivers and challenges for managers, as well as the impact for investors and the broader industry.

We strive to give you the best information, so you can help your clients make better decisions, and feel more confident about doing business with you. We believe that not only can everybody win, everybody should.

Reach out to us today about your research and consulting needs, and how to make the data work for you, and your clients.

Would you like to see research on a Managed Fund, then enquire here?

Image credit: Visual Capitalist

Comments are closed