The views of the Research IP team on responsible investing, impact, the 17 Sustainable Development Goals (SDGs), Environmental, Social and Governance (ESG) considerations and the United Nations Principles for Responsible Investment (UN PRI).

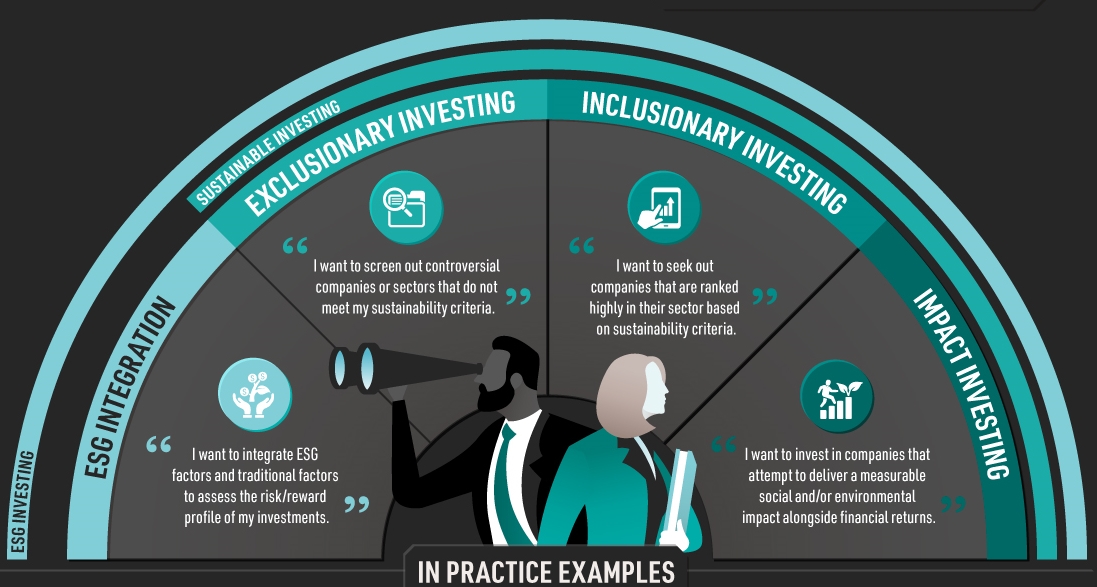

Responsible investment, socially responsible investing, sustainable investing, ethical investing, green investing, and ESG. What are the differences between these investment terms? How long has responsible investing even been around?

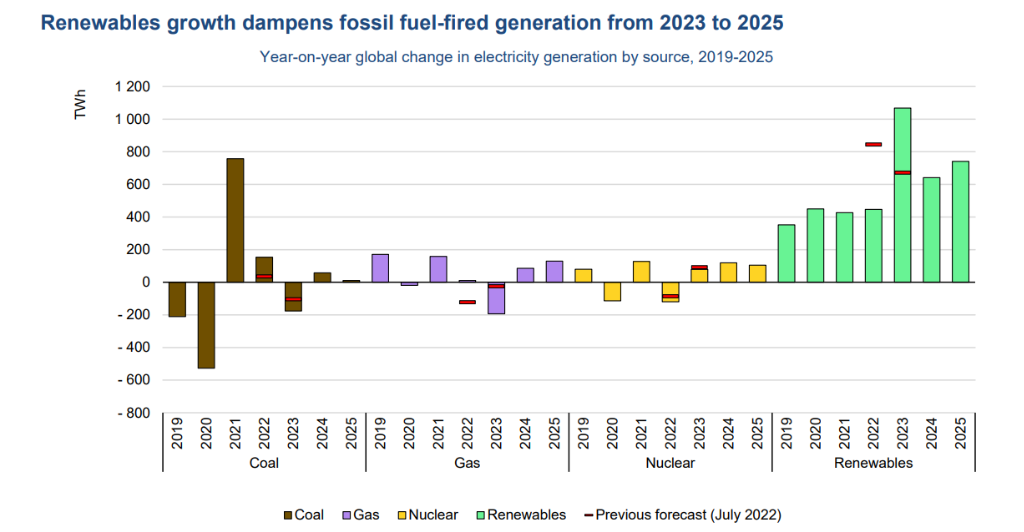

Extreme weather events in multiple regions caused power system challenges in 2022. Fuel prices surged after Russia's invasion of Ukraine, leading to a rise in coal-fired generation. Renewable power generation is set to increase more than all other sources combined, with renewables making up over one-third of the global generation mix by 2025. Nuclear output is expected to grow by 3.6% per year on average. Low-carbon generation sources are expected to meet more than 90% of additional electricity demand over the next three years.

Research IP believes independent, objective, and holistic analysis is required to understand the efficacy and nuance of different responsible investment strategies and how these relate to investors’ altruistic objectives. Independent research will give investors something to hang their hat on when evaluating which managed funds suit their objectives. This is particularly relevant for those Kiwis who end up in a Default fund and may wish to make an active choice and change to a different KiwiSaver provider.

The review of the KiwiSaver Default Provider arrangements in 2021 was seriously imbalanced. What do the new Default funds look like and how do they compare to the fund managers’ equivalent non-default balanced fund? What criteria can you use to make a balanced assessment of the funds on a forward-looking basis?

Comparing KiwiSaver fees is like comparing apples to oranges. The intricacies inside the required disclosures make accurate comparisons difficult and time consuming, not to mention the time taken to find all of the relevant information in the first place. Even the inclusion of GST is inconsistent.

We are excited to announce a new partnership for Research IP in New Zealand, interest.co.nz is now providing you access to over 300 RIPPL Effect reports to better “help you make financial decisions”.

Fund Managers are a very important part of the part of the investment landscape. Pension funding systems around the world heavily invest via fund managers, be they internal or externally appointed. Most Australian and Kiwi investors have exposure to a managed fund (also known as a mutual fund) via superannuation and KiwiSaver accounts. For Australians the predominant structure is an Australian Unit Trust (AUT) and for Kiwi’s this is via Portfolio Investment Entities (PIE). Most funds held within pension systems are diversified funds, largely because they are a default fund for the scheme provider.