Typically fund managers make decision based around the next 3-5 years. Looking at where employment will trend provides some insights into where capital may flow, which can highlight value traps. After all, jobs growth is linked to the need for capital investment to support revenue growth. The change in jobs growth can also highlight where efficiencies or structural changes are occurring then can improve profit growth.

To misquote Shakespeare – Bubble, bubble toil and trouble? Has Research IP turned its focus to the housing sector? Perception is everything.

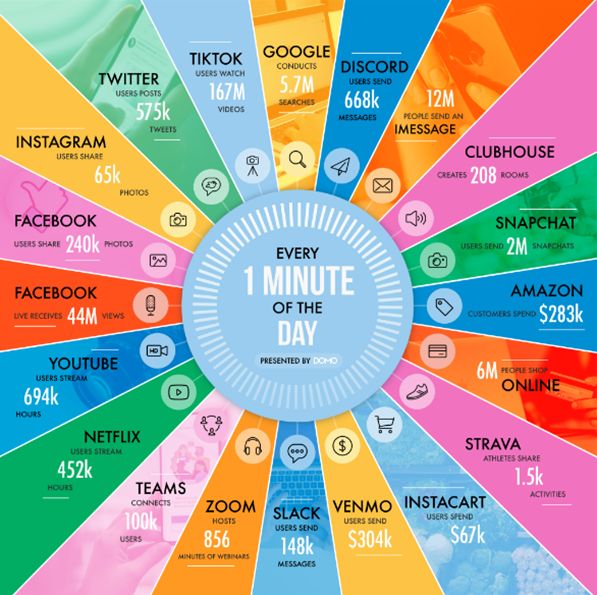

What apps or websites use the most data? How many stories do you post on Instagram or Facebook? How much money have you spent shopping online in the past year?

Magellan has announced that Hamish Douglass will take a medical leave of absence. With the recent departure of the CEO, relative underperformance and losing their largest mandate, is this the beginning of the end?

We live in an extraordinary time for the global economy. Despite supply chain and workforce issues, a commodities boom and rising energy costs, the US Federal Reserve and European Central bank are keeping low interest rates frozen. But with the inflation spectre looming on the horizon, former US Federal Reserve Governor Kevin Warsh says the window of opportunity for central banks to act may already be closing.

Omicron and zero-covid policies through China and South East Asia have the potential to disrupt global supply chains, heightening the risk of sustained inflation and therefore downside risks to financial markets.

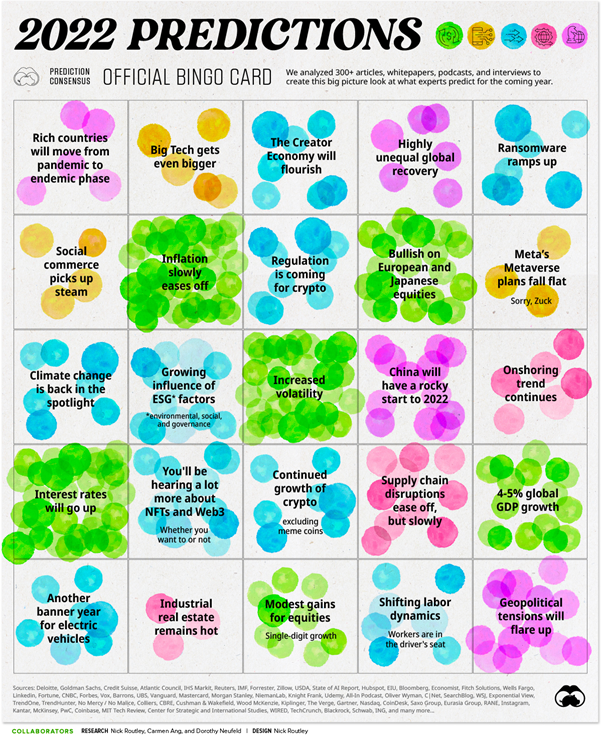

Do you feel good about 2022? What is it going to bring? The early pacesetter is the Omicron variant of COVID-19, ripping up the charts, in a not so positive way, but the world continues its march forward. Aspirational goals and settings have been made.

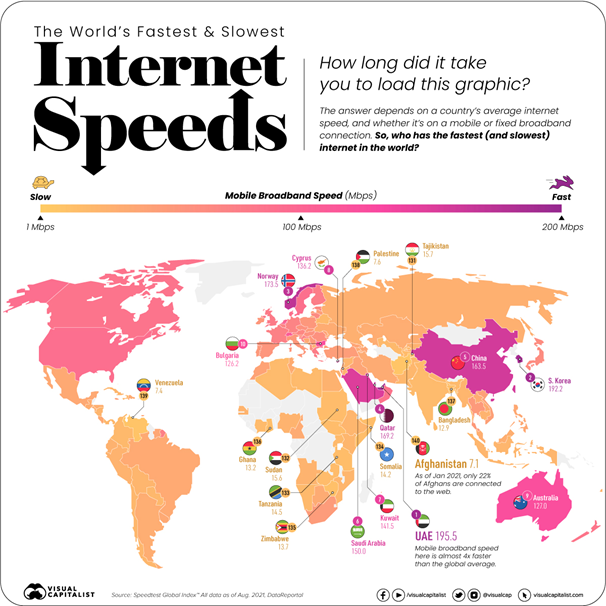

Checked your speed lately? In an increasingly digitised world, the speed of your internet connection matters. It dictates how you engage with the world.

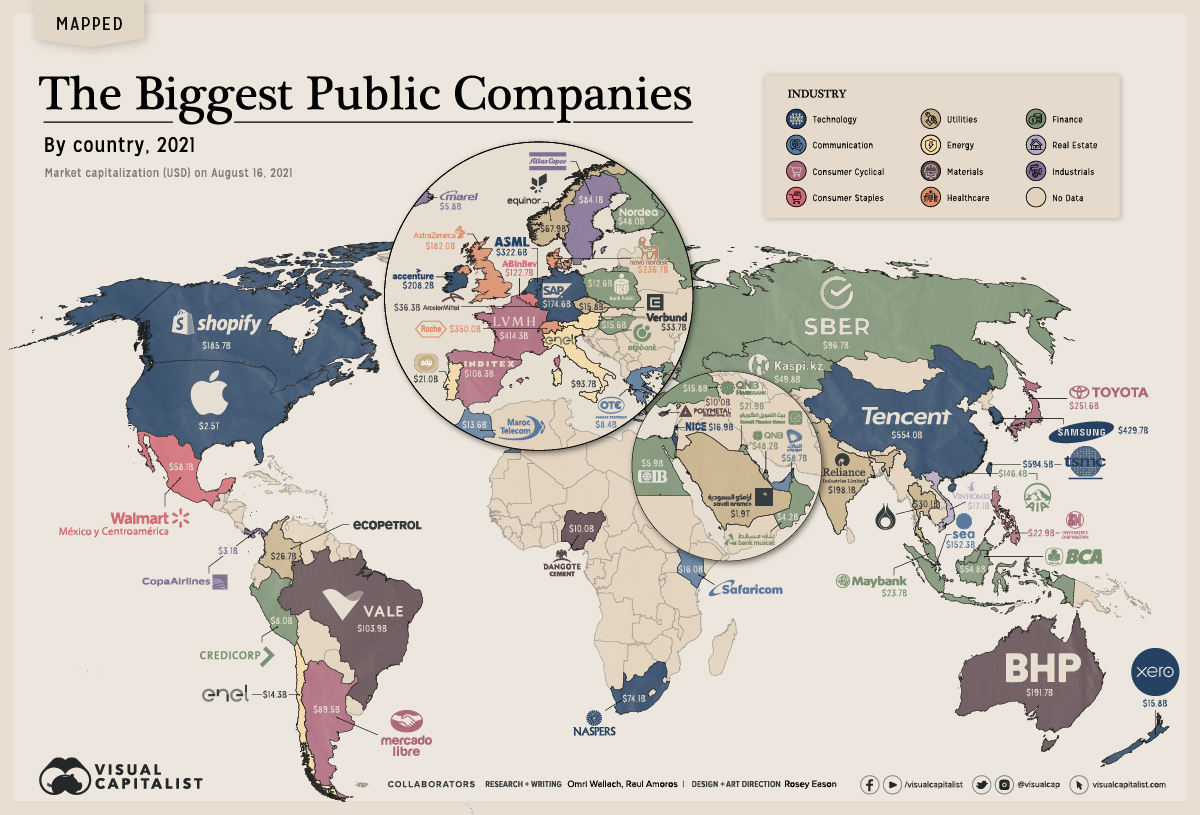

Tech and financials dominate, but does a passive product meet your needs and objectives.

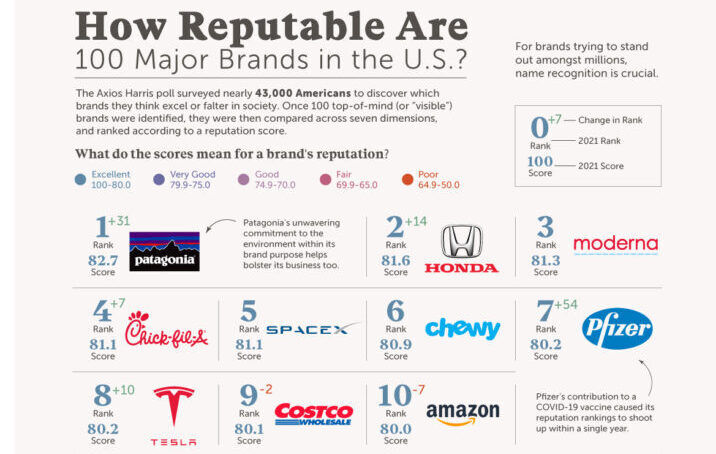

Branding is something that is critically important to a company, with billions of dollars invested to support a company name each year. How many of the companies named in the infographic are you invested in?